Each year, Google processes billions of automotive industry queries across the United States. In fact, 69% of people use Google Search to find answers when they need automotive services.

In automotive PPC, the competition is fierce! Understanding the most current auto industry trends and car advertising tactics gives smart marketers a leg up on the competition. That’s why we took a good look recently at the state of search marketing for automotive industry advertisers.

Our data pool at WordStream is deep, spanning billions of dollars in Google Ads spend annually. We dug into that data to discover the average cost per click, average click through rate and more, specific to the automotive vertical. We’ve also got some interesting new data from Google on car-related search and car advertising trends in 2016. Check it out.

Mobile Search & Advertising Trends in the Automotive Industry

I’m sure you’re tired of hearing about the mobile-first world. Too bad! Auto searches are definitely mobile-first: Just 41% of automotive-related queries are happening on desktop devices. Over half of consumers search for car-related queries on their phone, and 7% from a tablet.

See our Mobile PPC Basics & Best Practices resource for tips and tricks on better connecting with these audiences through your Google PPC campaigns.

The Importance of Location in Automotive Advertising

One of the things Google found is that half of all searchers will make their decision based on proximity to their home or office.

This tells us that if you’re doing car advertising and marketing automotive-related products/services, you’ve got a great opportunity to take advantage of Google Ads features like Location Targeting. In fact, if you’re using Ad Customizers with location-specific information, you can cut your CPAs in half.

Your website is critical, too, because 69% of searchers will check out an automotive industry website before making a purchase. Obviously, if you don’t have a website, you’re going to be overlooked. But the quality of your site matters, too – 71% of searchers don’t take further action if the website they visit lacks relevant, current information. Think of the sexy, engaging imagery and video content top auto brands are using; car advertising is so competitive, consumers won’t settle for boring or minimal effort.

Average Click-Through Rates & Costs Per Click in Automotive Advertising

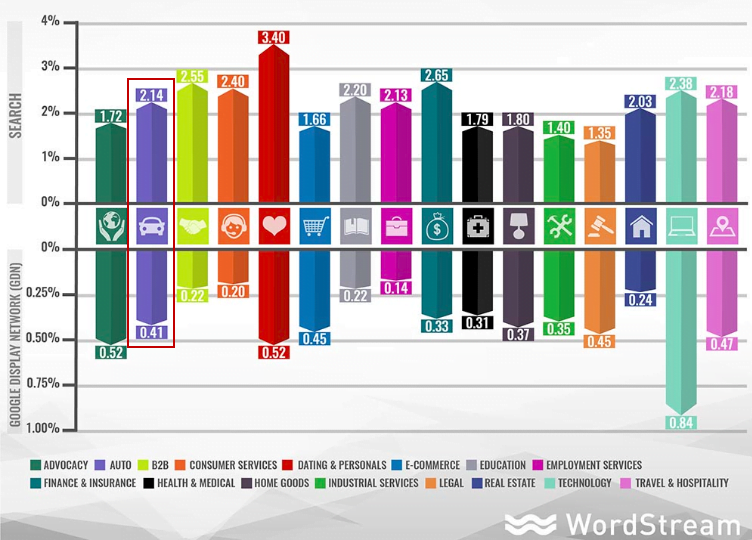

We learned in our research earlier this year that automotive advertising enjoys a better than average CTR, at 2.14% (compared to 1.91% across all industries). See the purple bar in the red box (second from the left) below:

The average CPC stacks up pretty well against the industry average of $2.32 across the search network. In automotive PPC, advertisers are paying a CPC of just $1.43, on average.

New Auto Industry Trends in Google Search & PPC for 2016

This is an industry where most of the top searches are branded; the terms with the highest search volume are GM, Toyota, Ford, Honda, and Tesla (see the top 20 below). This means there’s great opportunity there for smart marketers who can tap into long-tail search queries.

Check out these other automotive PPC and SEO insights and see if you can adjust your campaigns to capture more of those 742 million search ad clicks!

![Search Advertising Benchmarks for Your Industry [Report]](https://www.wordstream.com/wp-content/uploads/2024/04/RecRead-Guide-Google-Benchmarks.webp)