Welcome to the 2020 edition of our State of the Agency report! Every year, we survey hundreds of digital marketing agencies around the world about the tools they use, the challenges they face, the prices they charge, and more. And with the COVID-19 pandemic causing so many shifts, it’s more important than ever for agencies to have visibility into the larger PPC and digital marketing landscape.

This year, we opened the survey up to even more agencies for even stronger results. We also asked some new questions beyond PPC to explore agency business practices and sales processes. We’ll dive into this overall agency management data first before taking a deep dive into PPC trends specifically. Ready to get an inside look at internet marketing agencies in 2020? Read on! But first, a note on COVID-19.

A note on COVID-19

This survey was conducted prior to COVID-19 becoming a pandemic. While the outbreak has created many new challenges for agencies in 2020, it has also come to magnify many of the key takeaways you’ll read in this report.

-

Acquiring new clients will continue to be a top challenge for agencies, with many needing to narrow their new client targeting to industries that are in high demand, such as health and medical, on-demand media, and ecommerce businesses.

-

Retaining clients, which was already a growing challenge area, will now become a top priority for agencies. What will be important here is helping clients adapt ad copy to COVID-19 and suggesting more pandemic-appropriate strategies.

-

Having the right technology will be crucial in accommodating shifts to online models and remote work and reporting tools will be essential for informing your pandemic-adjusted strategies

Now that we’ve got that covered, let’s dive into overall agency management.

>> Looking for the most recent State of the Digital Marketing Agency report? We’ve got you covered!

Overall agency management

The first half of our report is aimed at overall internet marketing agency patterns. This includes size, acquisition strategies, services offered, tools used, and general challenges.

1. In what country are you located?

While some of the agencies in our survey run international campaigns, others are internationally based. Though metrics may vary by country, PPC is an effective, worldwide marketing strategy.

2. What is your job junction?

Almost half of those who took this survey are the owner of their agency. This was good to see, as it means that ultimate decision makers were active participants. We can also infer that smaller agencies or one-man shops are more common, as 64% of agencies also reported having fewer than 10 employees. [Question #3]

3. How many people work at your agency?

A majority of agencies are in the 2-10 employee range. This smaller number may be due in part to the challenges of hiring and onboarding new employees—which we’ll see in Question #13.

4. How many clients does your agency have?

The more clients you get, the easier it is to get more clients. What we might be able to glean here is that 25 employees is the tipping point for digital marketing agencies, in that once they hit that threshold, they experience a growth spurt. This is supported by the heavy reliance on client referrals, as we’ll see next.

5. What is your agency’s main source of acquiring new clients?

As with last year, referrals are the main source of new clients for about half of the agencies surveyed. Interestingly, upsells from other products and services dropped from 20% to 2%. Agencies have been less dependent on upselling as a source of acquiring new clients over the years, but this is by far the biggest year-to-year drop.

With COVID-19 causing a spike in social media engagement, this channel is likely to gain some more traction for agencies in 2020.

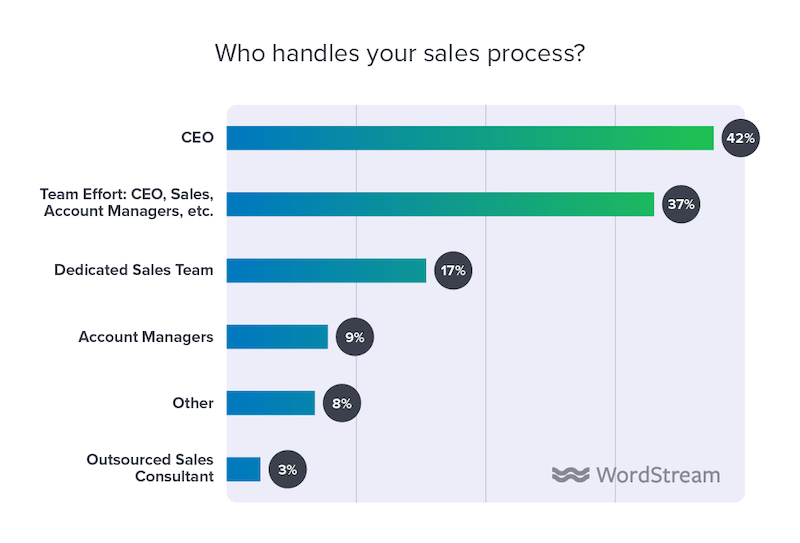

6. Who handles your sales process?

With CEOs involved in the sales process for many agencies, it seems like most have not yet reached a size or state that requires a systematized sales process. Growing an agency while also preserving its distinguishing characteristics and priorities is a delicate balance; that’s why it’s important for agencies to keep scalability in mind as they build out their teams and offerings.

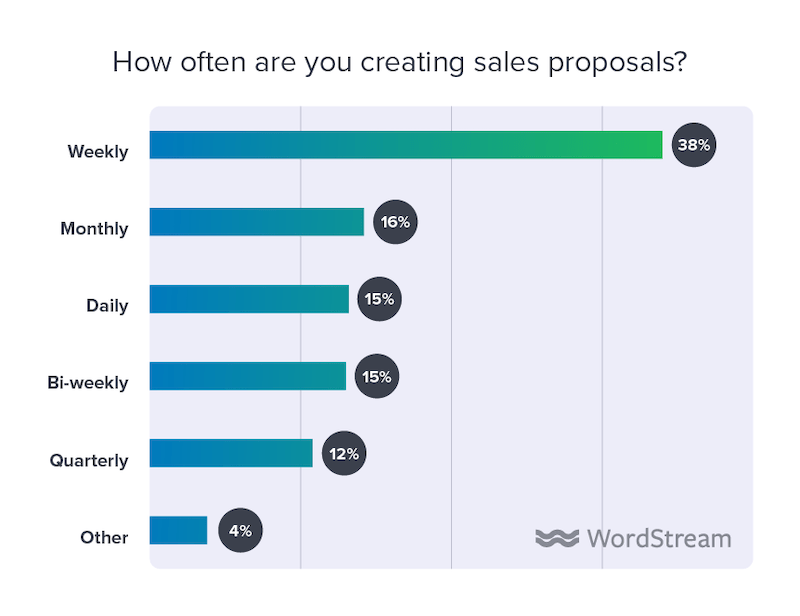

7. How often are you creating sales proposals?

The majority of agencies are creating sales proposals weekly, which is great news. Agencies creating them daily may benefit from a proposal generator tool, while those creating them on a less frequent basis may want to revisit and revamp their nurture strategies.

8. What is your average customer lifespan?

One of the biggest benefits of digital marketing is that it yields data that can be used for continuous optimization. This allows digital strategies to be sustained over the long term and may explain why clients are staying with agencies for more than two years.

9. What services does your agency offer?

While social, SEO, and web development were neck and neck last year, the results took a different pattern this year. Social joined PPC at the top, while SEO and web development lowered in frequency to be more on par with content and email marketing.

This isn’t surprising, as PPC and social media are both growing channels. PPC has new networks popping up left and right, and social media’s targeting capabilities continue to get more and more granular.

We added some new service options this year, as well. Reputation management, local listings, and ecommerce each came in at the lowest percentages, while landing page creation/optimization was as popular as web development.

10. Do you outsource any of these services?

The fact that 41% of agencies don’t outsource is consistent with the finding in Question #6 that 42% of agencies still involve CEOs in the proposal process. This suggests that most agencies haven’t scaled to a point of outsourcing.

Those that do outsource do so with web development, which makes sense—that’s a more comprehensive service. By contrast, the other services employ overlapping skill sets that are more accessible through online courses and training.

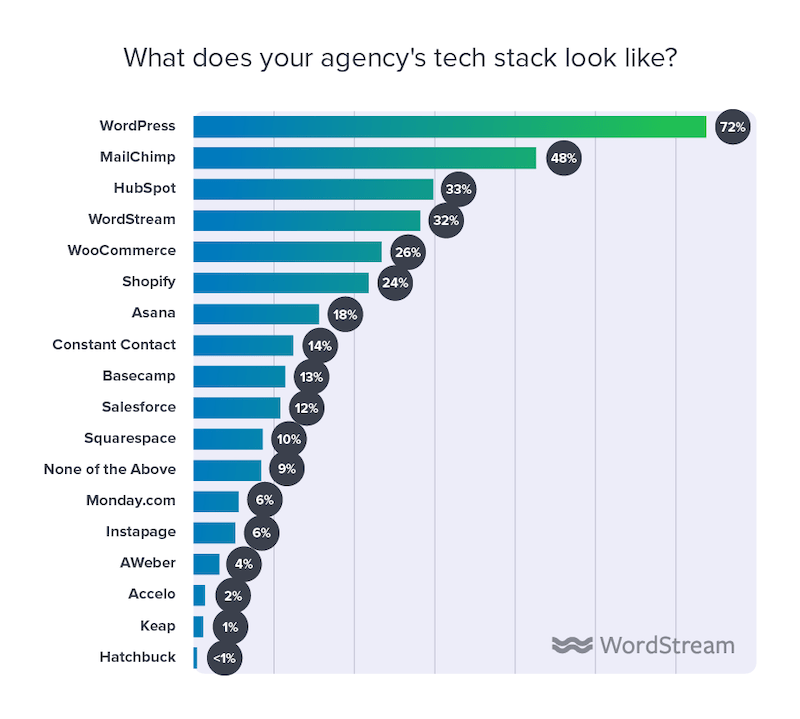

11. What does your agency’s tech stack look like?

Technology is the key to running an agency efficiently, and with so many teams working remotely due to COVID-19, it’s more important than ever to have a solid tech stack. This includes a variety of tools for various purposes, such as for content publishing, client engagement, and project management.

In the website realm, WordPress was seven times more popular than Squarespace. For email, Mailchimp more than tripled Constant Contact.

12. What does your agency use for reporting?

Google Data Studio is, by far, the most popular reporting tool among agencies. Data Studio enables you to create customized, interactive dashboards from a variety of data sources, including Google Analytics.

Perhaps most surprising is that 26% of agencies don’t use a reporting tool. Yikes! Reporting is essential for measuring your success, optimizing your budget, and communicating your value to clients. One barrier to entry for reporting is the challenge of making sense of the metrics. In this case, comparing them to industry benchmarks can be helpful.

13. What are the biggest challenges your agency will face this year?

The top two challenges are the same as in 2019, but getting new clients has taken a greater lead in 2020. With PPC being such a popular service offered by agencies (see Question #9), standing out from competitors may be getting more difficult. This may also explain why retaining new clients is also of greater concern this year than last.

Hiring/training new employees also jumped from 7% to 31%, which is consistent with responses to Question #10 that the demand for full-time PPC employees is growing.

14. What resources do you use to learn more about the industry?

Agencies are continuing to turn to a variety of industry experts to stay on top of digital marketing and agency strategy. Consistent with prior years, the top experts include Google, Wordstream, Moz, Hubspot, SEMrush, PPC Hero, Search Engine Land, and Neil Patel.

15. What content types do you most prefer?

Blogs rank highest as the preferred method for staying educated. With the exception of Pantheon (a premium podcast subscription), audio and video resources are not far behind. These findings also serve as a reminder for agencies that blogs and audio/visual content should be part of their own content marketing strategy.

Deep dive into PPC

Over 57% of the agencies we surveyed offer PPC as a service. The second half of our report focuses on the trends within this service, in terms of platforms, account optimization, resources allocated, and success metrics.

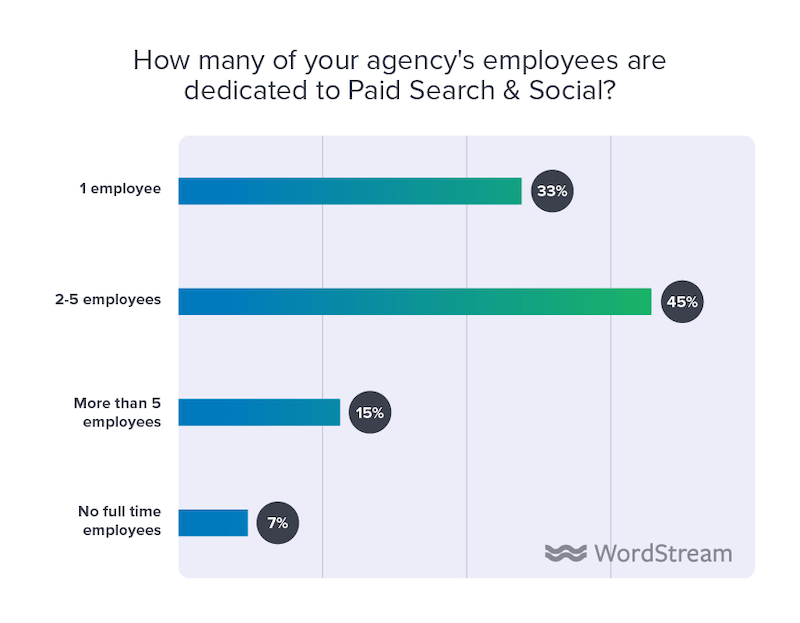

16. How many of your agency’s employees are dedicated to paid search and social?

While the percentage of agencies that employ just one person to manage paid search and social remained consistent with last year, the rest of the numbers have changed significantly. Not only has the number of agencies with more than one employee increased but also, the percent of agencies with no full-time employees dropped significantly. This shows us there is an increased demand for dedicated paid search employees.

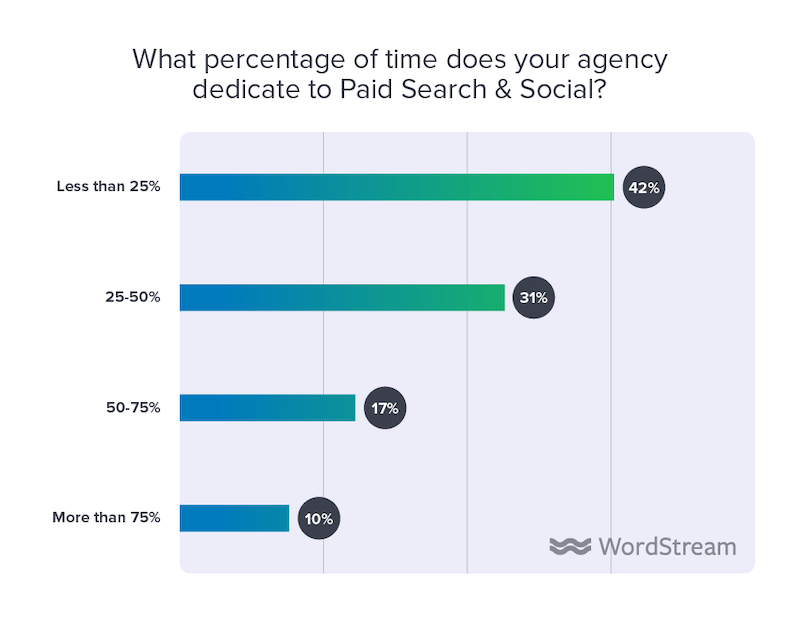

17. What percentage of time does your agency dedicate to paid search and social?

It makes sense that as agencies spend more time on paid search and social, they’re also dedicating a greater percentage of their overall time to these services. Not only was there an increase in the percent of agencies who dedicate 75% of their time to it, but there was also a decrease in those who dedicate less than 25% of their time to it. This makes sense, as the versatility and real- time feedback that makes PPC so popular also makes it high maintenance.

18. How do you price your PPC services?

Both flat fee models (flat fee alone and flat fee plus percentage of spend) were used twice as frequently than the percentage of spend model. Flat fee was more popular than percentage of spend in last year’s report, as well. This is understandable, as percentage of spend can result in a fluctuating monthly revenue.

19. What percentage of the paid search or social accounts you manage were not created by your agency?

For most agencies, a majority of the accounts they manage did not already exist, meaning their clients had not previously advertised on their own or they wanted to start fresh. The inference here is that agency clients are less likely to try PPC out on their own and are more likely to work with a trusted agency who can build out effective campaigns for them. Starting with a solid foundational account structure is crucial for PPC and helps foster the long customer lifespan we see in Question #8.

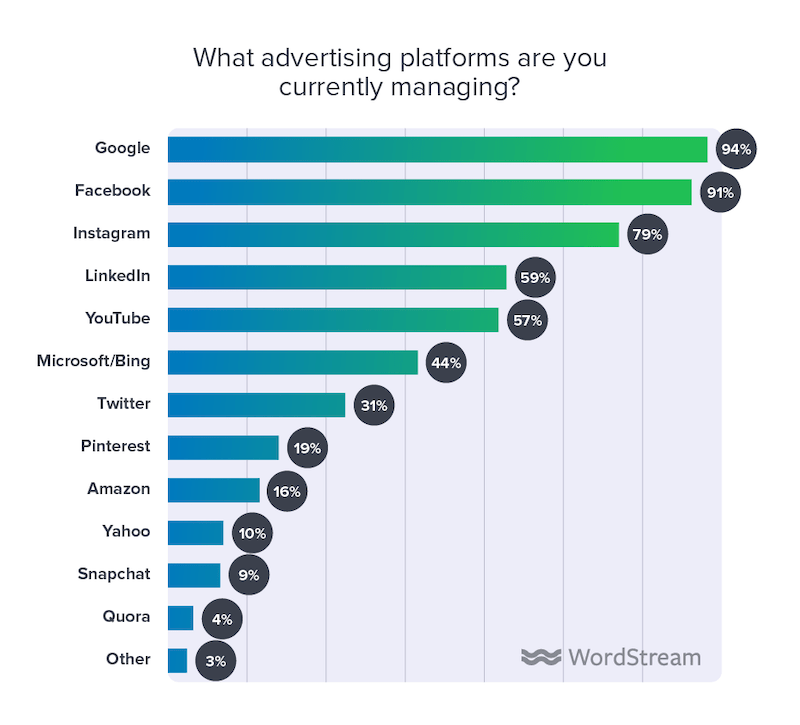

20. What advertising platforms are you currently using?

Google and Facebook continue to be the top two advertising platforms by far. Instagram, however, was not too far behind this year, with a big jump up from 57% in 2019. Interestingly enough, we added Pinterest this year, which turned out to be slightly more popular than Amazon.

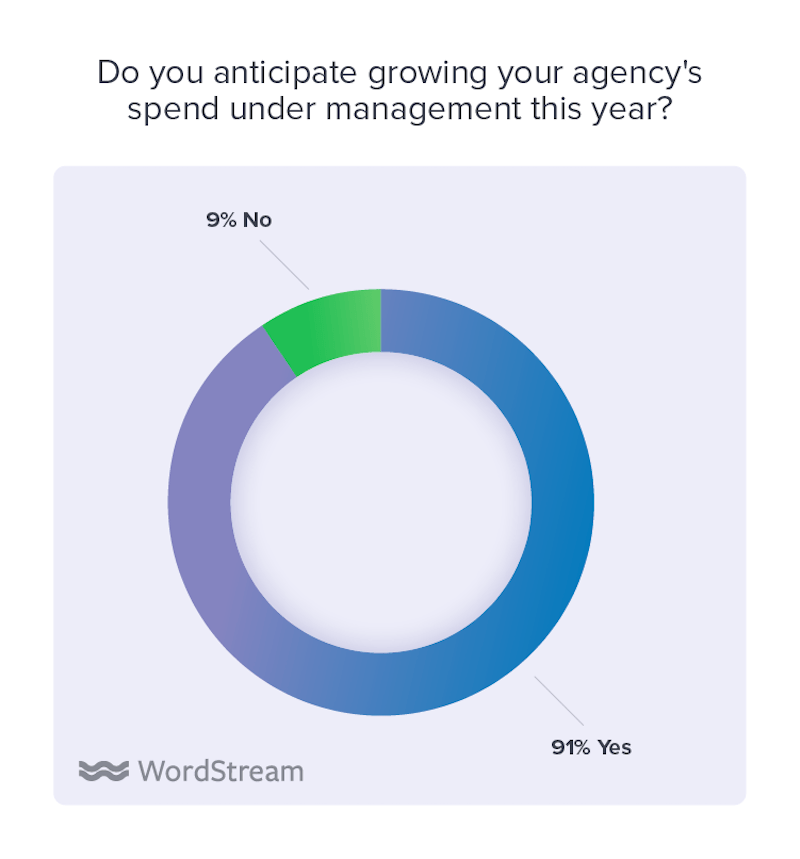

21. Do you anticipate growing your agency’s spend under management this year?

This response is in line with last year’s findings that 89% of agencies had increased their spend under management, while just 11% had decreased.

22. In what channels do you predict the most growth?

It’s to be expected that the three most popular advertising platforms (see Question #21) are also the three that agencies expect to grow the most.

23. How much time do you spend managing clients’ paid search and paid social accounts?

Just as agencies are dedicating more full-time employees to paid search and social than last year (see Question #17), they are also spending more time on these channels. While it is important to actively monitor and adjust PPC campaigns, there is much that can be automated to save time.

24. When optimizing an account, what do you prioritize first?

It is expected that keyword research is the top priority, as keywords are the building blocks of any digital marketing strategy. You need to know what you’re targeting in order to improve ad copy; and you need to know how competitive your targets are in order to set the right bid.

25. What is the primary success metric for your clients?

Conversions are the clear winner here as the most common primary success metric.

26. What are the biggest challenges you face in managing paid accounts?

In an industry that’s constantly changing, it’s not surprising that keeping up with change is the biggest challenge for most digital marketing agencies.

State of the Agency 2020: Key takeaways

- Efficiency is not enough. Last year, agencies grew in PPC spend with fewer full-time employees dedicated to paid search. This year, agencies grew both in spend and in time and staff dedicated to paid search. While efficiency was the solution last year, prioritizing PPC may be the trend this year, as evidenced by the decline in previously popular services (SEO and web development) and the lead taken by paid search and social.

- Training is in demand. With agencies spending more time on—and not outsourcing— paid search and social, the demand for full-time PPC employees is increasing. Adequate training is needed to scale up and retain both clients and employees.

- Agencies are getting it done. With most agencies staying under 25 employees and using all hands on deck, we can see that bandwidth is somewhat limited. However, customer lifespans are long and healthy, indicating that resources, automation, and reporting tools are helping agencies to adequately meet their clients’ expectations.

- PPC is a moving target. While getting new clients is an ongoing challenge, keeping PPC changes and trends is a full-time job. New networks are emerging, existing platforms are evolving, and most agencies are using a cross-platform strategy. This means convenient, high-quality training to help agencies and their employees stay competitive is essential.

- Digital is survival. Digital methods of marketing and operating have always been key, but with COVID-19 they have become crucial: Reporting tools and online resources are essential for quickly adapting strategies; a solid tech stack is needed to keep remote teams running smoothly, and online marketing is in higher demand now than ever.

A huge thank you to Kate Lindsay, Elisa Gabbert, Amanda Oles, Kim Castings, Ceillie Clark-Keane, and our wonderful customers for their help in collecting this data and creating this report.