How to Prepare Your Business to Withstand a (Potentially Upcoming) Recession

March 19, 2021

While unfortunate but not unexpected, some economists and watchers of the American economy have suggested that the US may be headed for a recession sometime in 2021. As a matter of fact, some commenters have categorically stated that the US economy is already in a recession. So if one were to combine these two schools of thought it is perhaps safe to infer that the recession may only get worse in 2021 and beyond.

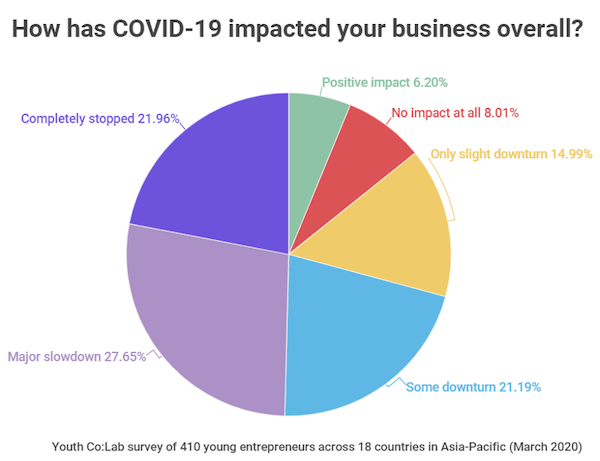

The source and reason for this prediction is not too difficult to see; the COVID-19 pandemic that devastated not just the United States, but the entire world.

And with the economy and society rocked by the health crisis, we’re already at a disadvantage. The question then is what can be done to prepare for it? While it is hoped that governments at all levels will begin to take necessary measures reduce its effect on the economy, businesses, can still take it upon themselves to take measures to cushion the effect.

In this post, I’m going to cover six ways to limit the impact of the potential next recession on your business. But first, lets go over the facts about recessions.

What is a recession?

A recession is defined by the National Bureau of Economic Research (NBER) as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

Can a recession be predicted?

Since the very first recession that was recorded in the United States in 1797, some reports have it that there have been as many as 47 recessions ever since. While recessions are an unavoidable fact of our lives, perhaps one of the silver linings about them is that modern-day economists are now able to predict, with a high degree of certainty, the possibility that a recession may occur in an economy. Perhaps the only unknowns about them are how long they will last and the severity with which they will occur.

The ability to predict the possibility of a recession happening means that economies can better prepare for them, potentially avert them, or at least minimize their effects.

Do recessions yield any benefits?

In as much as recessions are generally known to have negative effects on economies, they are not all about doom and gloom. For all the talk about their negative impacts on economies, businesses, and individuals, recessions are also known to bring with them some positive things. Perhaps most importantly is the correction that it brings to the system.

6 tips to limit the impact of the (potential) next recession on your business

While we cannot control whether a recession will occur, there are some things you can do to increase your chances of surviving. In this section, I’m going to go over how to use business relationships, diversification, cash flow, marketing, and more to protect your business as much as possible.

1. Maintain, improve, and nurture business relationships

The bread and butter of any business is, without a doubt, the relationships it has with various stakeholders ranging from customers, creditors, suppliers, employees, and more. How these relationships can work towards helping your business survive a recession will differ, but whether individually or collectively, they can make a difference.

For example, your long-time, loyal customers are likely to keep using your business, even if times are tough and there are lower prices elsewhere; and good relationships with your creditors and suppliers can give you access to vital lines of credit or raw materials that may be needed during hard times.

2. Diversify your offerings

One of the pillars of any successful business is its ability to diversify. Businesses that are able to master this art during periods of economic boom stand a greater chance of not being as drastically hit by a recession than a mono-product or service business.

The reasons for this are perhaps easy to see. A diversified business has a diversified revenue stream. During recessionary times when certain types of products and services take a hit and see a reduction in demand, a company’s diversified product list means that one or more of its products might just be the ones that will continue to generate revenue and keep the business afloat.

In other words, don’t put all your eggs in one basket; you need to have some agility so you can adapt to changes in consumer behavior and the economy.

3. Protect your cash flow

The cash flow of a business is very important to its survival and health. Your business’s cash flow can be kept positive by doing things like being frugal with your business’s expenses, building and maintaining a healthy cash reserve, making sure that your customers’ debt obligations to your business are met are often as possible, and more. The flip side of that coin is equally important; keeping all outgoing cash flows from the business at a minimum.

4. Keep debt and expenses to a minimum

Debt is a double-edged sword that can be used as a tool for growth, but at the same time it can be the source of one’s downfall if not managed properly.

When an economy is in great shape, debt can contribute to the growth of a business in a variety of ways. The other side of that coin and the negative effects of debt, especially high levels of debt, comes into play when an economy is experiencing a recession. During these times of reduced activity, your business might not be generating as much (or any) revenue and may consequently be unable to service your debt when creditors come calling.

Some businesses have an escape route if they have done something as simple as formed an LLC or any other business entity that gives you the option of filing for business bankruptcy, and consequently, exempts you from repaying the business debt. It is important to mention, however, that there are times when that “‘corporate veil” will be pierced and you will personally be held liable for your business’s debt.

5. Continue marketing

It is quite logical for most business owners to stop their marketing activities whenever there is a downturn in the economy and their businesses. However, unconventional wisdom advises us that rather than completely ceasing your marketing activities during a recession, you will be better off by continuing to market it, or at the very least scaling it back a little, but never to the point where it stops completely. Also, as important as marketing is to the survival of your business, so also are the other resources that can help to grow your business both pre and post-pandemic.

The thinking behind this is simple. When you (continue to) invest in marketing that educates and informs your current and potential customers on how they can get a better bang for their buck, and how your product or service can meet their needs at a time when they are looking to make informed changes to their spending or buying habits, then they are likely to continue supporting your business.

Image source: GOBankingRates

6. Keep your workforce minimal

Having to lay off your workforce is one of the hardest things that you will ever have to do as a business owner. The feeling will be much worse if these employees have families that depend on them and the income they earn from your business is for their livelihoods.

Yet, during a recession and the downturn in business activities, this is exactly what you may need to do, especially if many of the things that have been discussed in this article have not been done.

It is, therefore, very important that you always keep your workforce at the barest minimum at all times. Just because your business is doing well is no reason to go on a hiring spree. And if you absolutely must hire more staff, perhaps you should first consider hiring part-time workers of freelancers. Doing so will mean that your staff level will be at a more manageable one, and during a recession, you will not have a bloated workforce. In such a situation, you just might be better able to keep them employed, even if at a reduced pay rate.

On a final note, it is noteworthy to mention that whenever you work with part-time employees or freelancers, it is important to ensure that a solid contract is drafted by a good business attorney to ensure that your business is properly protected from all manner of situations that could potentially occur in such settings.

Prepare for a potential recession with these tips

Just as there are no guarantees in life, taking any of the above-listed steps does not guarantee that your business will come out of the recession scot-free, but it may minimize its negative impacts on your business. To recap, here’s what we discussed:

- Maintain, improve, and nurture business relationships

- Diversify your offerings

- Protect your cash flow

- Keep debt and expenses to a minimum

- Continue marketing

- Keep your workforce minimal

Over and above the threat of a recession, the points mentioned above also make for good business sense and if implemented have the potential to help take your business to greater heights during a booming economy.

About the author

Kanayo Okwuraiwe is the founder of Telligent Marketing LLC, a digital marketing company that provides lawyer SEO services to help law firms grow their practices. Connect with him on Linkedln.