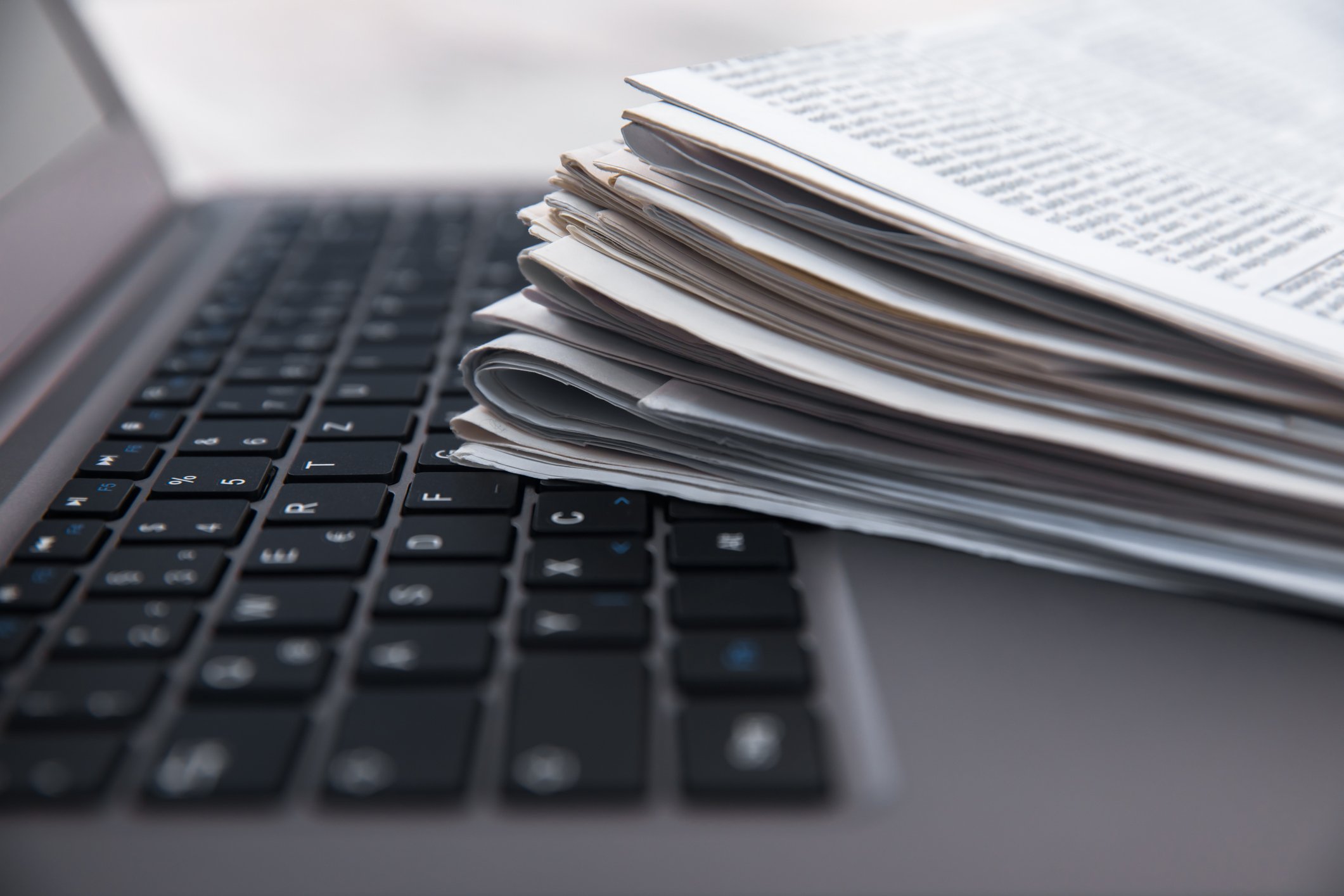

Unless you’ve been living under a rock for the last few years, you already know that the mobile market is becoming increasingly important. The big guys know this too – last summer, Google pushed advertisers into mobile with the transition to Enhanced Campaigns, and Bing recently announced it would be following suit this September. Experts are seeing mobile search volumes grow much faster than desktop, and some forecast they will even exceed desktop search volumes as early as next year.

Mobile vs. Desktop Local Search Volumes (BIA/Kelsey Forecast)

As mobile searches have been heating up, so have rumors about the implications for mobile advertisers. Rather than speculate, let’s quantify what’s important for mobile marketers out there today with real data. What’s a good CTR for mobile search ads? Is Quality Score calculated differently for mobile searches? Let’s take a look at some AdWords mobile data to fully understand how the search engine results page differs across devices.

Different Devices, Different SERP, Different Ads

It may go without saying, but the Google search page displays differently whether you are searching on your desktop, tablet or mobile:

Same search for “iPad mini” across different devices.

The clear takeaway is that there are simply fewer ad spots available on mobile devices. We’ve become used to seeing 3 top positions and a herd of ads on the right-hand side on desktop and tablet searches, but that’s not the case on mobile.

Mobile users might see up to 2 ads in the top positions, followed by organic results and then maybe two ads at the bottom of the first page. If you consider how the AdWords auction works, you can quickly see how the smaller inventory of ads on mobile implies that advertisers have to bid differently for mobile and expect different benchmark metrics for mobile search ads as well.

AdWords Mobile Click-Through Rate (CTR)

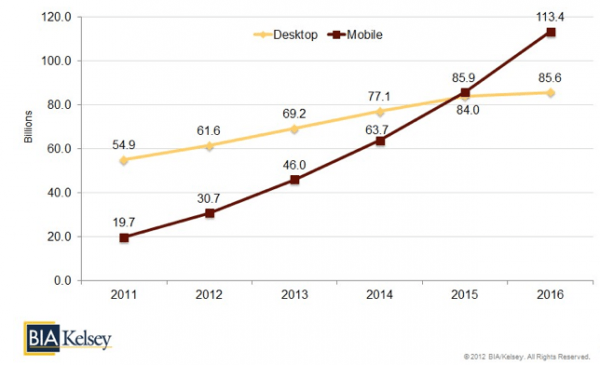

Larry previously published research on the expected CTR advertisers see in different ad positions. As you’d expect, advertisers in top positions generally get the best CTRs:

But when we segment that same data by device, we notice the severity of the tradeoff between position and CTR is much more dramatic on mobile:

While CTRs are fairly consistent across device in the top position, mobile CTR drops off a whopping 45% just between positions 1 and 2. Outside of the top position, mobile ads have much lower CTRs than their desktop peers and have similar CTRs to much lower desktop positions:

Mobile’s Impact on Quality Score

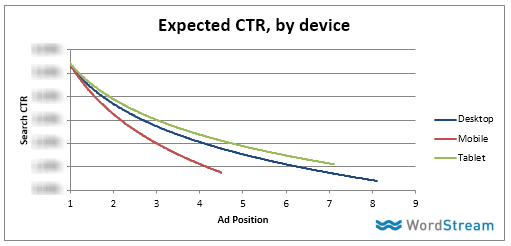

If mobile ads have lower click-through rates, and CTR is the driving factor in calculating Quality Score, then shouldn’t mobile ads have a lower quality score?

Fear not, paid search advertisers! Although you can’t segment your Quality Scores by device in the AdWords interface, Google recently released a white paper highlighting recent changes to the Quality Score calculation. In it, Google relieved advertisers’ concerns and assured us that a user’s device is taken into consideration when computing Quality Score. The same way lower CTRs are expected with lower ad positions, lower CTRs are expected with mobile ads. This also confirms our own internal findings that accounts with more mobile traffic do not see a penalty in their Quality Scores, despite lower CTRs on mobile:

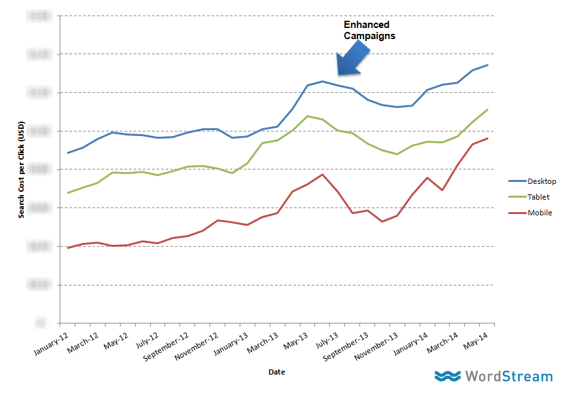

Mobile Cost Per Click (CPC)

As mobile searches have continued to heat up, their prices have too. Advertisers that have consistently been advertising on mobile since the beginning of 2012 have seen their CPCs increase by 150% – three times the increase that they’ve seen from desktop CPCs in the same period.

The forced migration to Enhanced Campaigns temporarily lowered the CPC for many mobile advertisers, but the last 12 months have seen rising mobile CPCs. While they are still comfortably below the costs of desktop and tablet, I would expect that gap to continue to decrease for now.

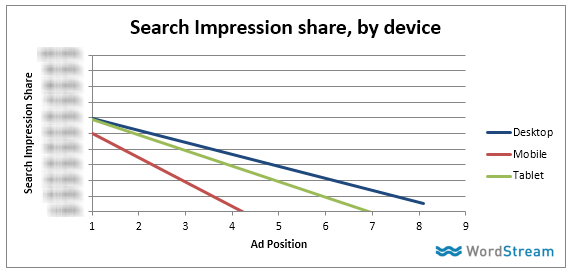

Mobile Impression Share

So mobile has a considerably higher CTR penalty for lower positions than on desktop, but what’s more damning is how infrequently these lower position ads even make it to the SERP:

Mobile ads are much less likely to be shown, even in position 1, than they are on desktop. Below mobile position 2, you’re not likely to be shown at all and even less likely to be clicked on. Across the hundreds of accounts analyzed in this study, there wasn’t a single account with mobile position below 4.3, where the impression share is practically nonexistent.

Google AdWords Mobile Data: Recap

So, to recap what we’ve discovered:

- Mobile search volumes have been growing exponentially over the past few years.

- Mobile CTR drops off 45% faster in lower positions than desktop or tablet.

- Search CPCs have been rising dramatically for mobile over the past 12 months.

- The mobile impression share penalty is more dramatic that its desktop counterparts.

The mobile PPC market is far more difficult for advertisers to be successful in than on desktop. If you don’t have a mobile strategy, you’re asking for trouble. What can advertisers do to break this mobile curse? We’ll follow up with a list of best practices we use in our accounts next week. If you have any questions or mobile strategies you’re particularly proud of that you’d like to see make our next mobile blog post, reach out to us on Twitter or LinkedIn or sound off in the comments!

Data Sources

This report is based on a sample size of 240 accounts representing US-based SMBs in all verticals. The report incorporates data from the Google Search Network between Jan 2012 and July 2014.

![Search Advertising Benchmarks for Your Industry [Report]](https://www.wordstream.com/wp-content/uploads/2024/04/RecRead-Guide-Google-Benchmarks.webp)