Keyword research is the foundation upon which all good search marketing campaigns are built. Targeting relevant, high-intent keywords, structuring campaigns into logical, relevant ad groups, and eliminating wasteful negative keywords are all steps advertisers should take to build strong PPC campaigns. You also need to do keyword research to inform your content marketing efforts and drive organic traffic.

Sometimes, though, you really need to figure out what your competitors are up to. What keywords are my competitors using?

Competitive keyword analysis is one of the most effective ways to compete in a crowded space and gain a crucial advantage over other businesses in your industry. So how do you actually find those keywords that your competitors are targeting in their paid and organic search campaigns?

Here are eight competitor keyword research tools and tactics you can use to find competitor keywords, so you can keep up with the Joneses (or leave them in the dust).

The 8 best tools to find competitor keywords

Here are the tools we’ll be covering in this round-up:

- WordStream’s Free Keyword Tool

- BuzzSumo

- Semrush

- Spyfu

- Ahrefs

- Google Auction Insights

- Seed Keywords

- Tag Clouds

And don’t miss our post on how to do competitor keyword analysis!

1. WordStream’s Free Keyword Tool

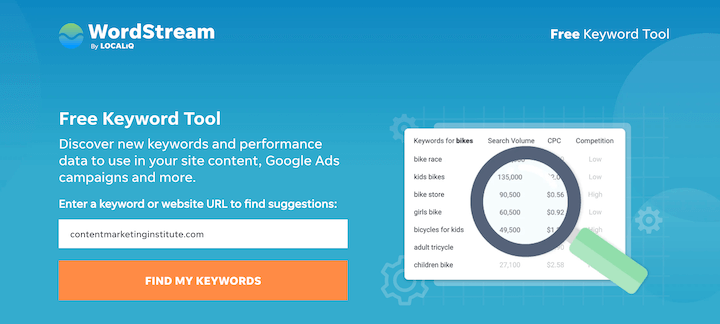

One of the best ways to find competitor keywords (if we do say so ourselves) is by using WordStream’s Free Keyword Tool.

How can we use WordStream’s Free Keyword Tool to find competitor keywords? Just enter a competitor’s URL into the tool (instead of a search term) and hit “Search.” For the sake of example, I’ve chosen to run a sample report for the Content Marketing Institute’s website by entering the URL of the CMI website into the Keyword field, and I’ve restricted results to the United States by selecting it from the drop-down menu on the right:

You’ll then be shown a range of competitive keyword data based on your search. This keyword data can be sorted and displayed by any of the four metrics included in the report – Google search volume, Competition, CPC, and Opportunity Score:

In this example, our results are displayed in descending order based on Opportunity Score, a unique metric proprietary to WordStream’s Free Keyword Tool.

These reports can be downloaded as .CSV files for easy uploading to your Google Ads or Bing Ads account (which you can do directly within WordStream Advisor, too), making the Free Keyword Tool an excellent launch point for further competitive intelligence research.

2. BuzzSumo

We’ve talked about BuzzSumo numerous times in the past, and that’s because it’s awesome. (And no, BuzzSumo didn’t pay me to say that.) For content marketers, it’s pretty much the perfect tool for competitive analysis, and one of BuzzSumo’s strengths is identifying potential competitors you may not have been aware of.

For example, most digital marketers are familiar with Moz. They produce excellent content, develop their own suite of awesome tools, and also lay on a pretty great annual conference, too. If you run an SEO blog or publish SEO-related content, you almost undoubtedly already know that Moz is among your most fierce competitors. But what about smaller, independent sites that are also doing well?

Enter BuzzSumo.

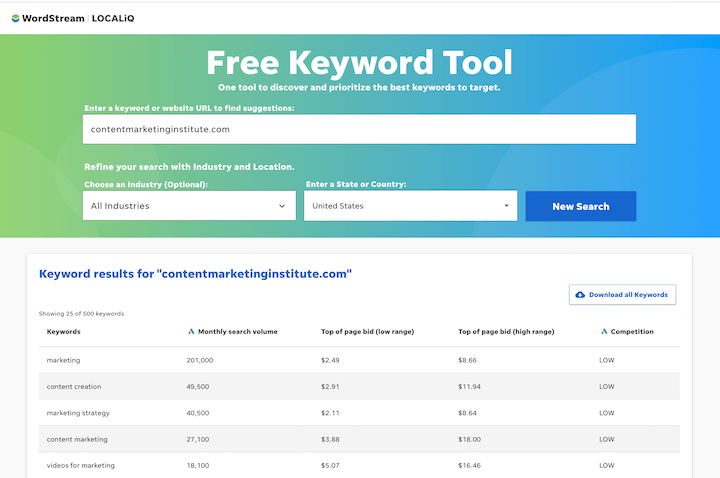

In the example search below, I entered “SEO” as my initial query – an incredibly broad term with millions of potential results. Here’s what BuzzSumo unearthed for me:

Obviously, we’re not interested in the top two results, as they both pertain to South Korean actress Park Seo Joon. But what about the next two results? Both were published by Mike Johnson at a site called getstarted.net – a site I’d never heard of prior to conducting this search. Check out those social share numbers, though – more than 35,000 shares for each article! This gives us a great starting point for our competitive intelligence research, but we need to go deeper. Fortunately, BuzzSumo’s competitive analysis tools are top-notch.

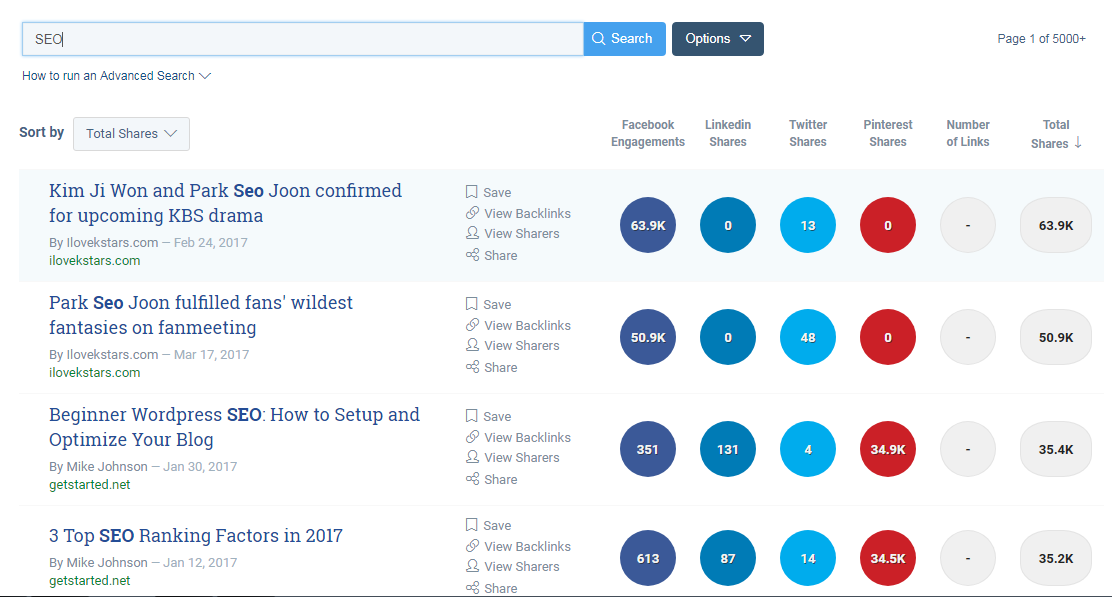

We’re going to use BuzzSumo’s Domain Comparison tool to compare two different domains across a range of parameters. For the sake of example, I’ve chosen to compare the Content Marketing Institute’s site against Copyblogger:

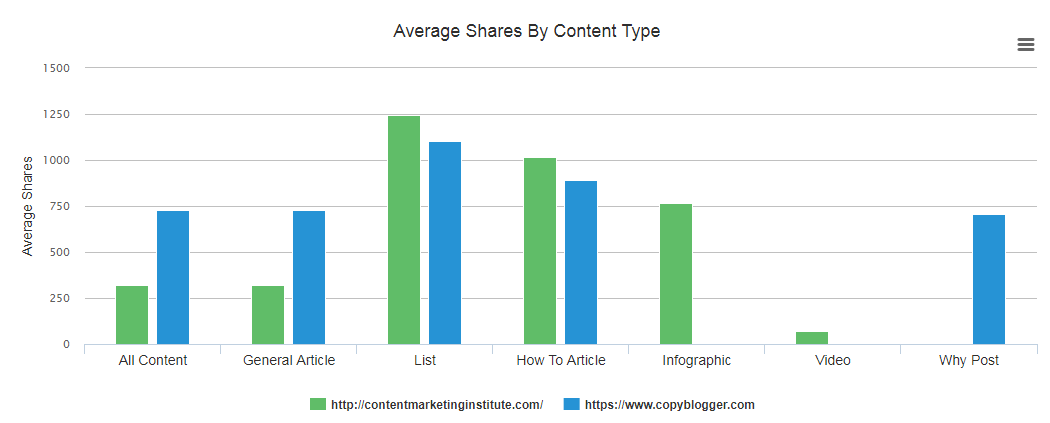

BuzzSumo will then provide you with a breakdown of how to two domains compare to one another. There are a range of reports available in the Domain Comparison tool, but two of the most interesting are the Average Shares by Content Type and Average Shares by Content Length reports:

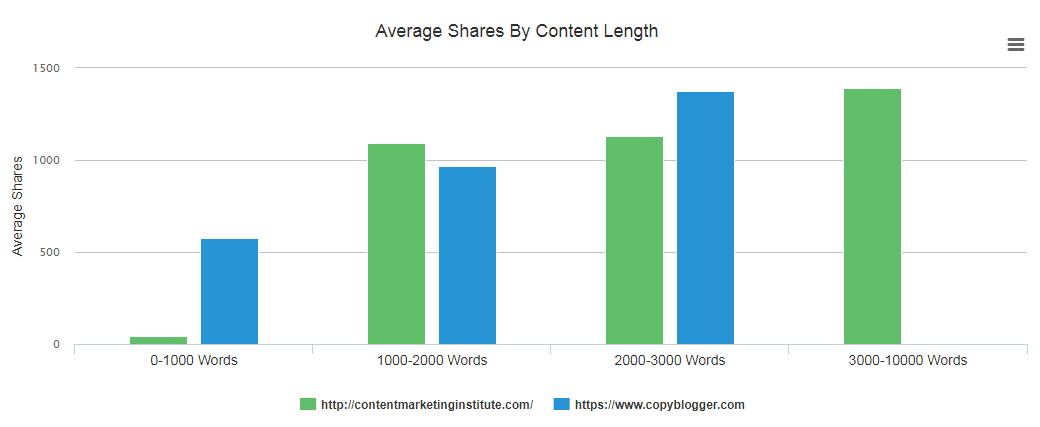

As you can see, the most popular content type for both the Content Marketing Institute and Copyblogger are lists, followed closely by how-to articles. This is already proving to be valuable data, but we can go deeper to see which articles are being shared the most by length:

Now we’re getting a much clearer picture of what’s working for these two publishers. As the graph above illustrates, long-form content performs well in terms of social shares, even at lengths of between 3,000-10,000 words.

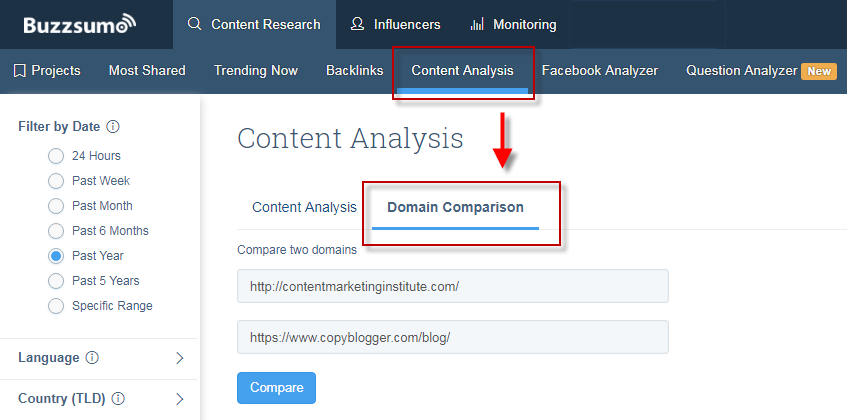

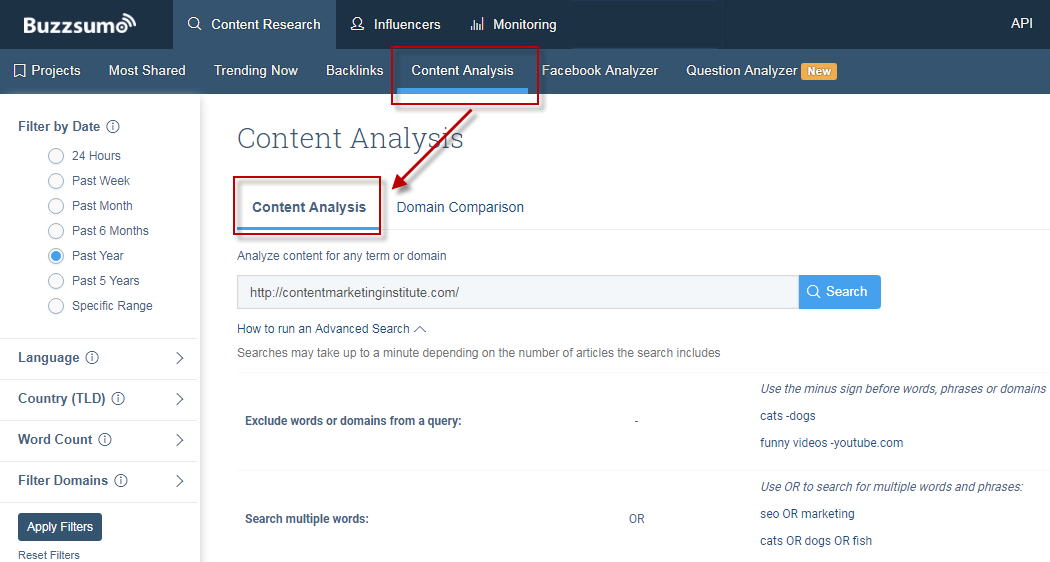

But what about specific content and those sweet, sweet keywords? Let’s dive into BuzzSumo’s Content Analysis tool:

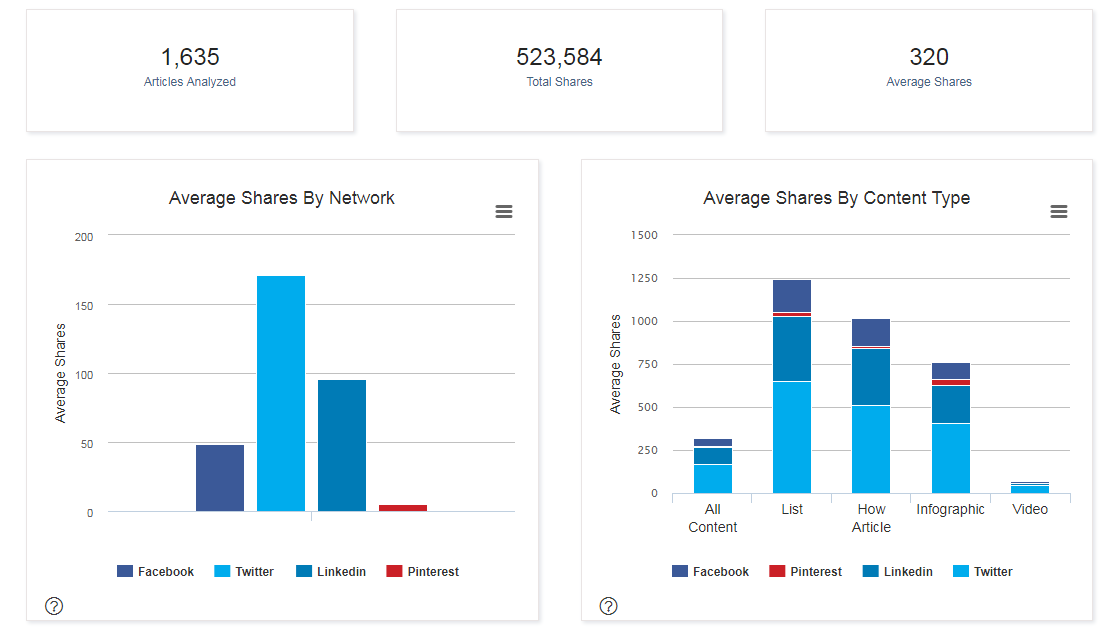

In the example search above, I’ve chosen to examine CMI’s website. First, we’re provided with an overview of content on the domain we’ve specified, which includes a detailed summary of that domain, including the number of articles analyzed, total and average social shares, and average shares by platform and content type as we saw in our domain comparison query earlier:

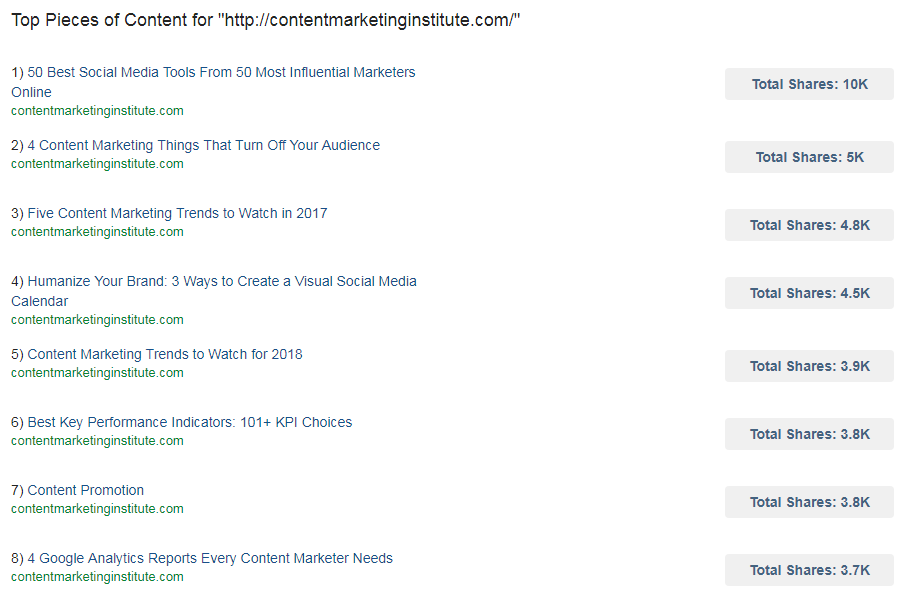

This overview is certainly interesting, but it’s not what we’re looking for – we want to know which individual articles have performed strongly during the past year. We can see this data by scrolling down past the dashboard summary to the Top Pieces of Content report:

The top result – 50 Best Social Media Tools From 50 Most Influential Marketers Online – is far and away the most popular article published by CMI within the past year with more than 10,000 shares, twice the share volume of the second-most popular article. Armed with this knowledge, we can use the URL of that article in another keyword tool to examine which specific keywords CMI’s most popular article contains. Sneaky, huh?

When it comes to competitive keyword research, BuzzSumo doesn’t offer a great deal of keyword-specific data. It has, however, given us an excellent starting point for further research.

RELATED: The 5-Step Competitor Keyword Analysis (+Template!)

3. Semrush

Our next competitive intelligence tool is SEM Rush, an impressive suite of keyword research tools that can help you identify competitor keywords quickly and easily. You can search by keyword or URL, filter results by geographical area or country, specify different match types for PPC keywords, and examine domain analytics data for entire sites.

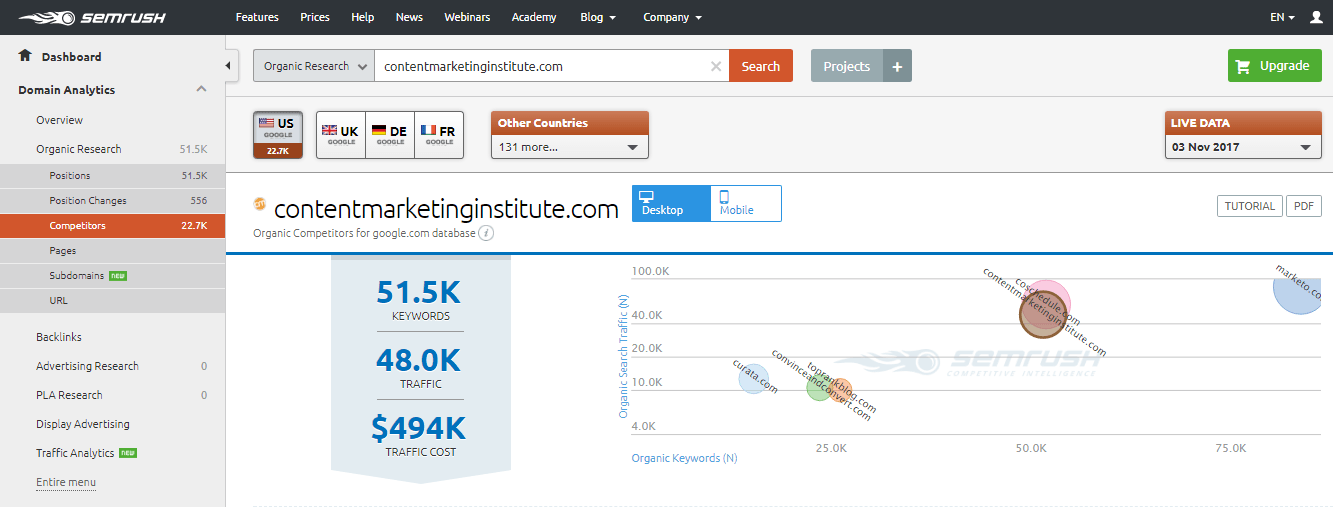

Let’s say we want to continue the research we began in BuzzSumo to find CMI’s top competitors. We can do this by selecting the “Competitors” dashboard, which can be found via the Domain Analytics > Organic Research menu:

For this example, we’re analyzing CMI’s organic keywords from Google.com data for desktop searches within the United States. You can change this to localized British, German, or French Google results if needed, and you can also choose between desktop or mobile traffic data.

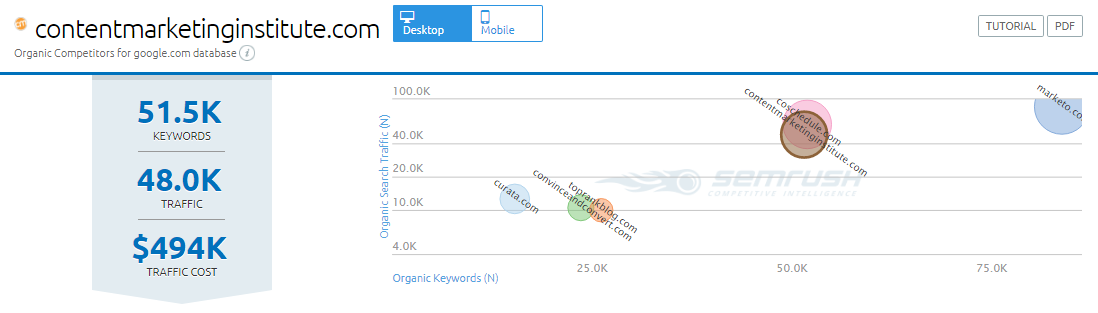

Next up, I want to see how CMI stacks up against similar publishers in terms of their organic keywords in relation to their organic search traffic. I can find this data by examining the graph that SEM Rush generates as part of this report.

As you can see below, CMI is very close to content marketing productivity app CoSchedule’s site in both organic keyword volume and organic search traffic. We can also see that there are more than 51,000 organic keywords across the CMI website, as well as traffic data and the estimated cost of attracting that traffic:

This data is definitely useful, but I want more – specifically, how CMI’s competitors rank for their keywords. This data can be found beneath the reports above, in the Organic Competitors report:

This is where things get really interesting.

As the table above shows, CMI’s top organic competitor is Curata. If we look at the traffic/keyword overview graph above, Curata appears to be of little threat to CMI; it ranks lower for both volume of organic keywords and organic search traffic, yet it’s listed as the top organic competitor in the above table. Why? Because SEM Rush doesn’t just factor in organic keywords and organic search traffic – it also factors in how many keywords a competitor’s site has in common with yours, as well as the number of paid keywords on the site (in Curata’s case, just one), as well as the traffic price, the estimated cost of those keywords in Google Ads.

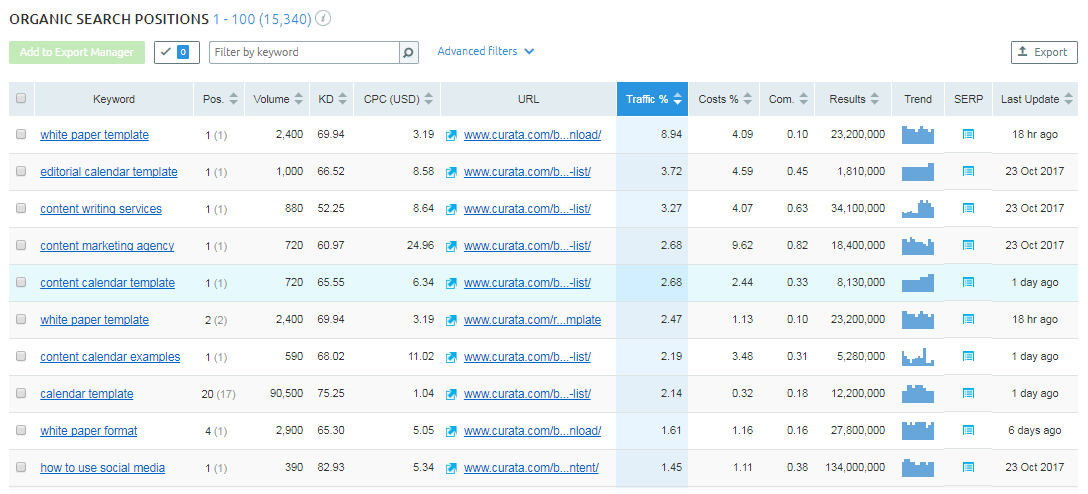

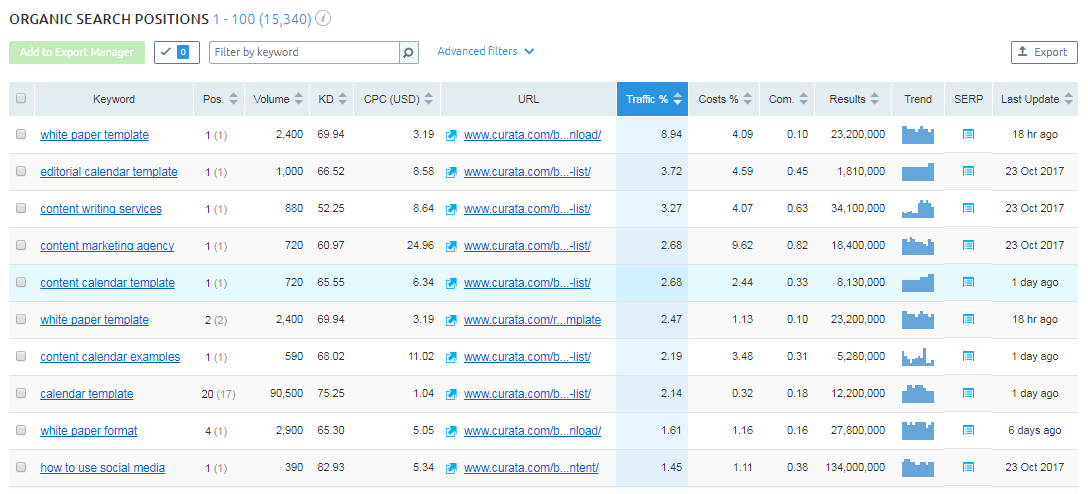

We can also see that Curata has approximately 15,300 search engine keywords on its site. What if we want to see what those keywords are? All we have to do is click on the data we want to examine:

That’s more like it! With just a few clicks, we can now see a wealth of competitive keyword data for Curata, such as the keywords themselves, their average organic position in the SERP, approximate search volume, the keyword’s difficulty (how hard it will be to rank for that specific keyword), average CPC, the share of traffic driven to the site by a particular keyword (displayed as a percentage), as well as costs, competitive density, volume of results, trend data over time, and an example SERP. Incredible.

Which keywords are burning your budget? Find out with our Google Ads Performance Grader today!

4. SpyFu

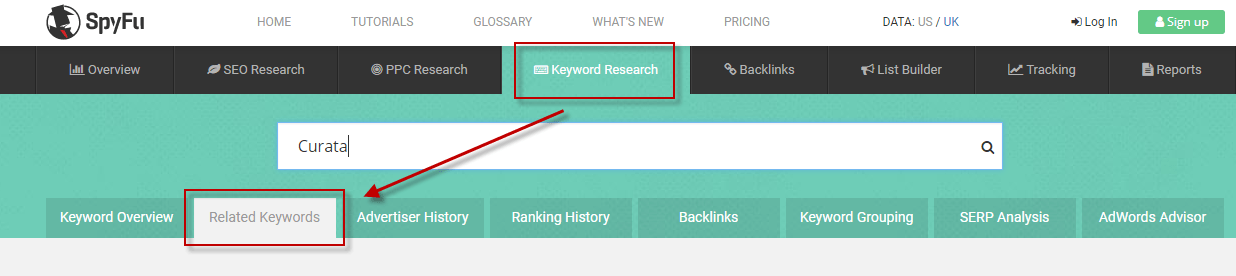

SpyFu is another popular competitive intelligence tool that can help you find competitor keywords. Unlike similar tools, however, SpyFu is a tool dedicated solely to competitive intelligence research.

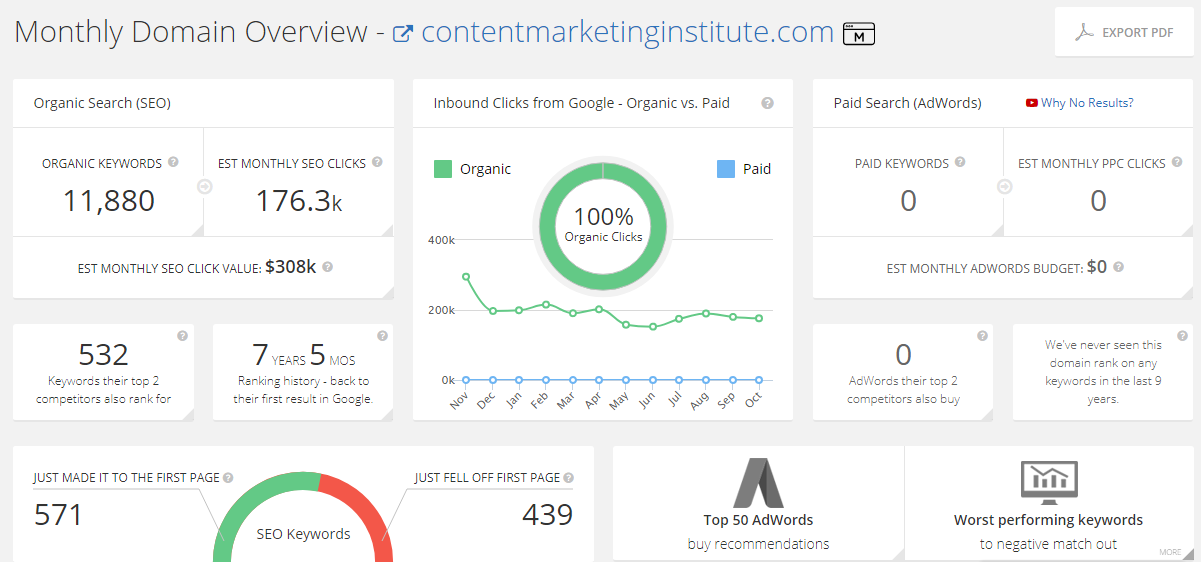

An overview of the domain dashboard within SpyFu

It’s actually pretty remarkable how much data SpyFu can provide, even for basic or cursory searches. Data on everything from local and global monthly search volume, CTR, ad spend, advertisement history, ranking history, backlinks, and ad groups is readily available, offering invaluable insight into your competitors’ keyword strategies.

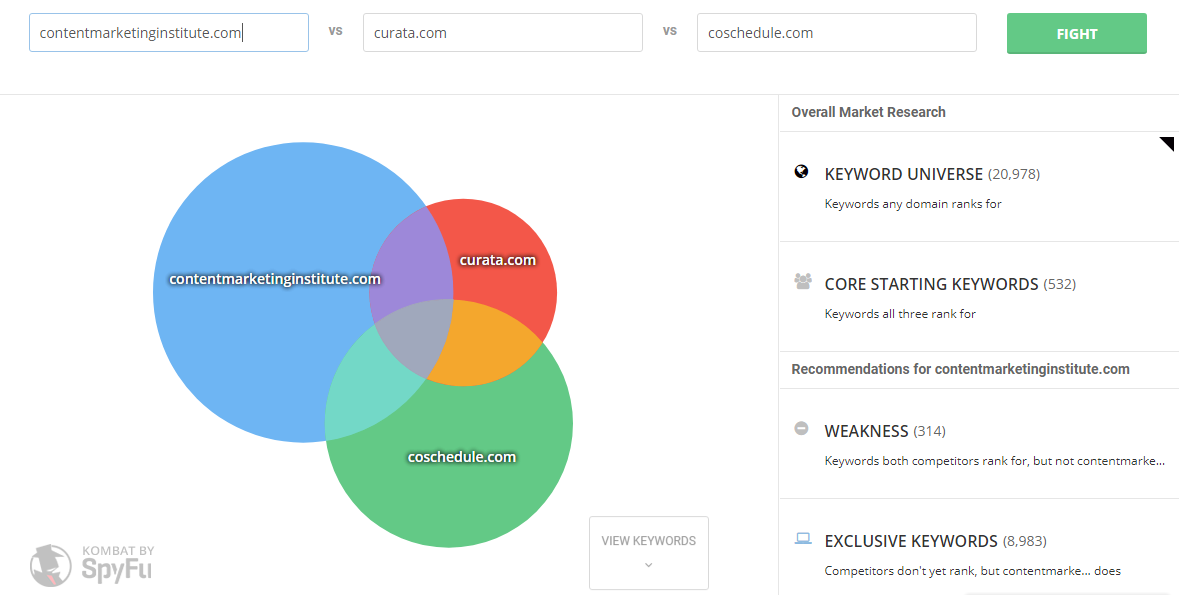

Let’s continue our research by selecting “Competition” from the menu to the left of our domain overview as seen above. This brings us to a novel and very cool feature of SpyFu known as Kombat, which allows you to pit three domains against one another to determine how competitive they are:

Even in a single click, we’re provided with a range of very interesting competitive intelligence data. These results are visualized as a Venn diagram, allowing you to quickly and easily get an idea of how CMI stacks up against Curata and CoSchedule, CMI’s two biggest competitors. On the right-hand side, you can select one of several submenus. Let’s take a look at the Weaknesses report, which lists all the keywords that both other competitors in our example rank for, but that CMI does not:

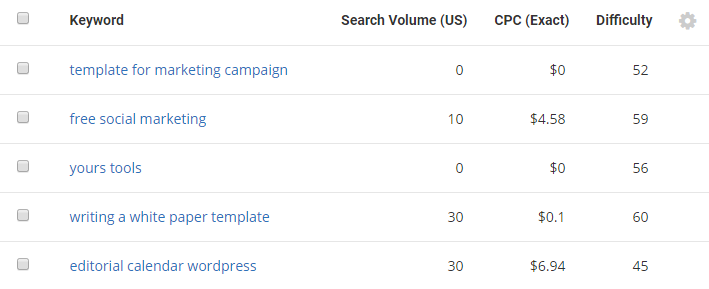

This list of keyword weaknesses (or opportunities, if you’re a glass-half-full kind of person) can be sorted by search volume, exact CPC, and keyword difficulty, and allows you to quickly and easily discover keywords your competitors are ranking for that your site is not – an invaluable part of your competitive intelligence analysis.

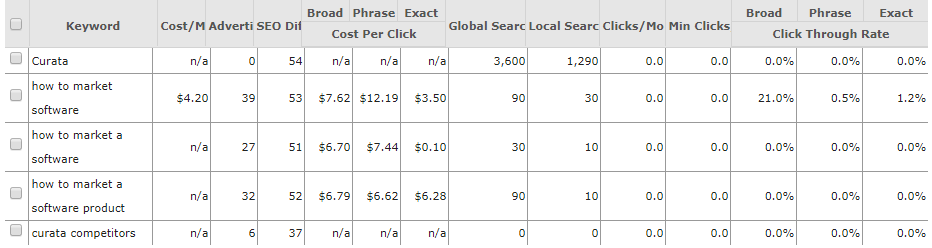

We can also drill further down into SpyFu’s keyword data to examine specific keywords from a competing site, in this case Curata. This is accessed by navigating to the Keyword Research > Related Keywords report:

This brings us to a comprehensive table of keyword data for Curata. This table contains data on pretty much every keyword metric you could ever need, including difficulty, CPCs for all three major keyword match types, local and global average search volume, and CTR for each match type.

SpyFu is a seriously powerful tool, and when you use it alongside other tools as part of your competitor keyword research workflow, you’ll be amazed at the data you can dig up.

5. Ahrefs’ Keywords Explorer

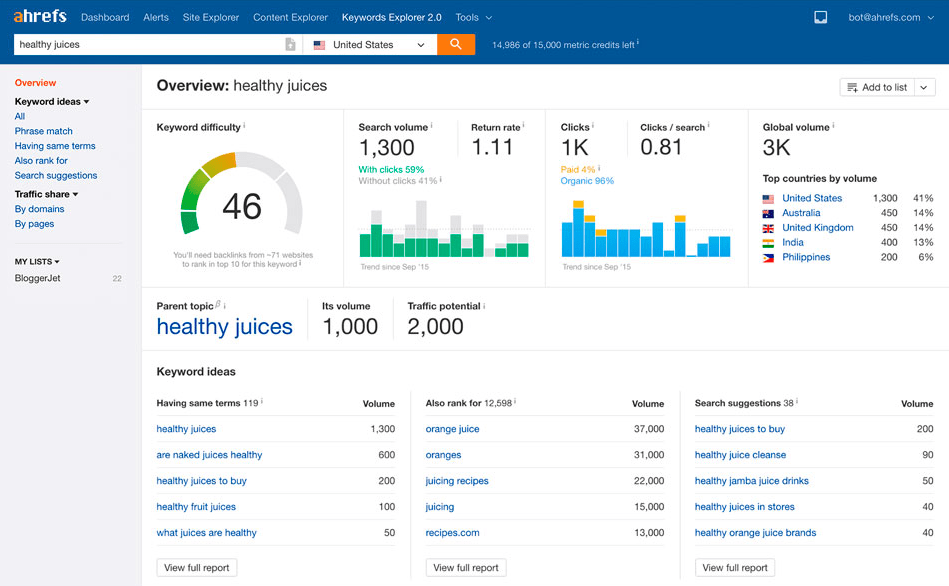

Ahrefs is one of the most widely read SEO blogs on the Web. In addition, Ahrefs is also the developer of a tool called Keywords Explorer, and while this isn’t a free tool, it certainly flexes a lot of muscle.

Image via Ahrefs

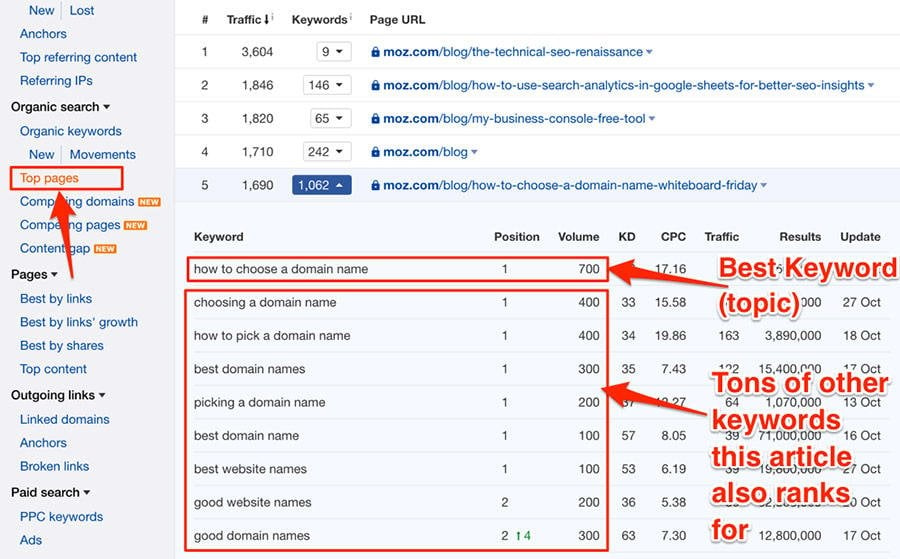

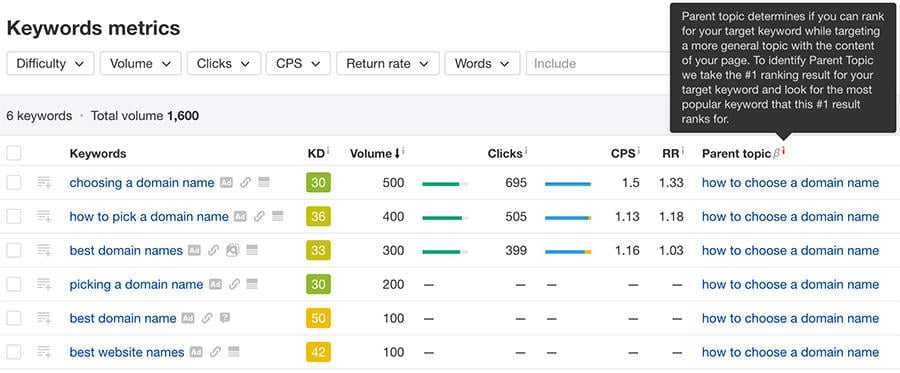

Keywords Explorer offers users tons of functionality and data that is invaluable to advertisers and SEOs alike. One of the coolest features, however, takes a slightly different approach to keyword research that is gaining traction in the SEO community, known as “Top Pages.”

This feature allows users to identify dozens or even hundreds of relevant keywords by focusing on the topic of a page or article, rather than the individual keywords themselves. Let’s see how this works courtesy of an example from Ahrefs.

Let’s say you already know who at least one of your top competitors is. You want to know what topics and keywords that competitor site ranks for, so you browse organic keyword data for that site – in the example below, our good friends at Moz:

Image via Ahrefs

As you can see in the image above, one of Moz’s articles – a Whiteboard Friday video focusing on how to choose a domain name – has decent enough traffic, but look at the number of keywords this article ranks for (highlighted in blue). More than 1,000 keywords in a single article! Each individual keyword has accompanying volume data, meaning you can see new potential keyword ideas and their approximate search volume in the same table – very handy.

Conventional SEO wisdom might suggest targeting each specific keyword with a separate page or article, and you could certainly take that approach if you have the time and resources for such an ambitious project. Using this technique, however, allows you to identify new competitor keywords by parent topic – in the above example, how to choose a domain name – as well as dozens or even hundreds or relevant, semantically related keywords at the same time, allowing you to do what Moz has done, which is target many different relevant keywords in a single article.

In addition to other useful data, such as search volume, CPC, traffic, and search result volume, Ahrefs’ Keywords Explorer also offers a wealth of historical keyword data such as SERP Overview and Position History to provide additional context to keywords that have waned in interest, volume, or average SERP position over time. This data could help you identify not only which specific topics and keywords have waned in popularity, but also how strongly each topic performed at its peak.

Even cooler is the fact that you can “reverse engineer” this technique; you can enter the keywords identified in the example above into Keywords Explorer, and the tool will show those keywords’ parent topic. This allows you to identify strongly performing articles and pages based on clusters of semantically related keywords – very cool.

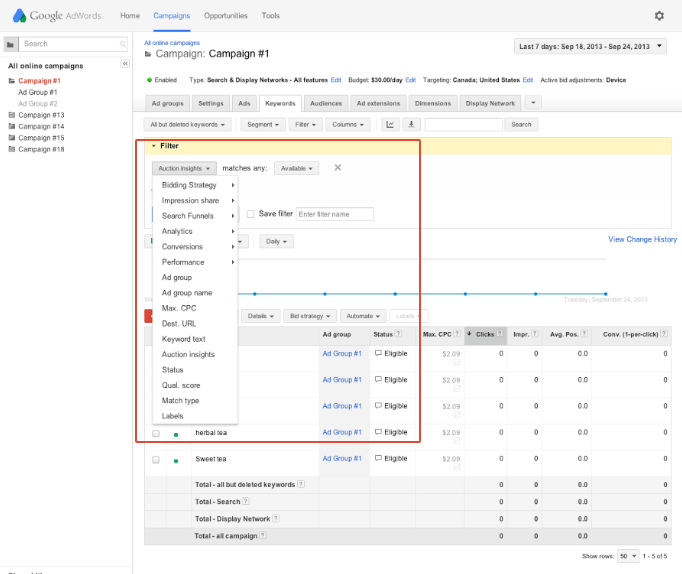

6. Google Ads Auction Insights

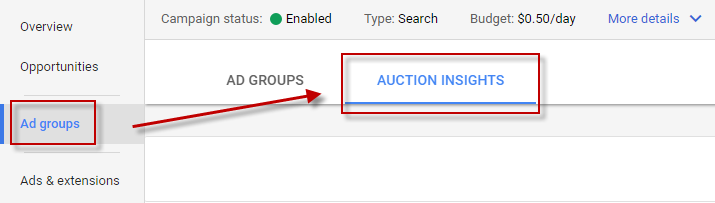

Our next technique for discovering competitor keywords is platform-centric, but it’s too useful to overlook – using Google Ads data to find out who your top-performing competitors are and what they’re ranking for.

To do this, we’ll be using Google Ads Auction Insights functionality. Experienced Google Ads advertisers may already be familiar with this report, but newcomers to PPC often overlook this data. To access it, simply navigate to an active Google Ads campaign, then select “All” under the “Auction Insights” tab:

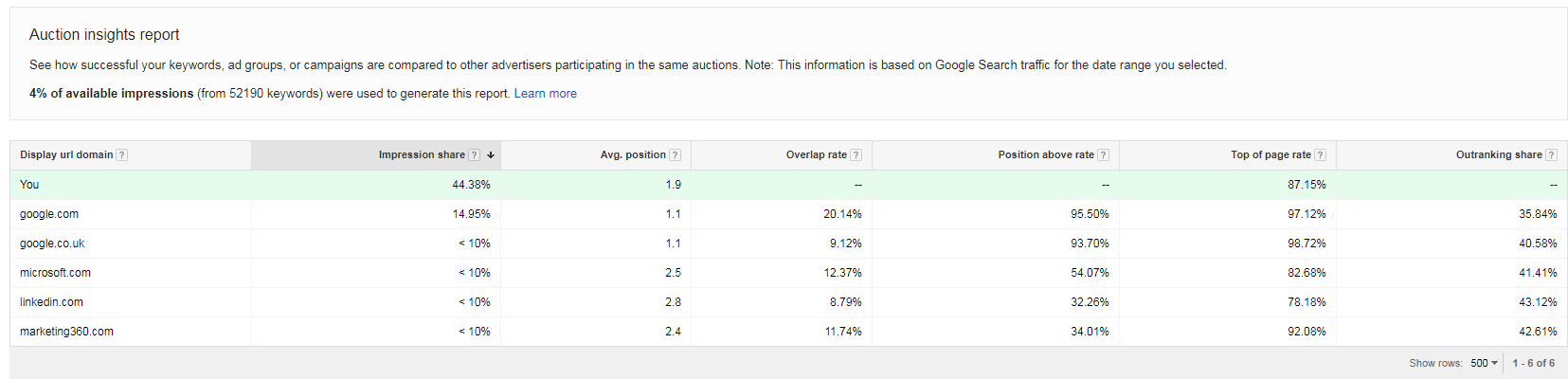

Once you’ve accessed the Auction Insights report, you’ll be able to see a range of competitive analysis data from your Google Ads competitors, including impression share, average ad position, overlap rate (how often your ads are displayed alongside those of a competitor), position-above rate (how often your ads outperformed a competitor’s ad), top-of-page rate (how often your ads appeared at the top of search results), and outranking share (how frequently a competitor’s ad showed above yours or when your ads aren’t shown at all).

This data will be displayed in an easy-to-read read report that shows you at-a-glance how your recent campaigns have performed compared to your competitors’ campaigns.

Google Ads Auction Insights reports can be filtered and refined based on a wide range of criteria. For one, you can view Auction Insights reports at the Campaign, Ad Group, and Keyword level. We’re most interested in the Keywords report, and by selecting the Keywords tab, you can filter the results to display the data you need. You can filter results by bidding strategy, impression share, maximum CPC, Quality Score, match type, and even individual keyword text, alongside many other filtering options:

Image via Google Support

One drawback of Google Ads Auction Insights report is that it only displays data for advertisers that have participated in the same ad auctions that you have, not all competitors with the same account settings or targeting parameters. This means that, by default, you’ll be missing some data regardless, as not every advertiser will compete in a given ad auction.

Still, considering that all this data is available from directly within the Google Ads interface, without the use of third-party tools, the Auction Insights feature is very powerful – be sure you don’t overlook it as part of your competitor keyword research workflow.

7. Crowdsourcing Keyword Research

Here at WordStream, we often tell our readers that hard data about how people behave is always better than baseless assumptions about how we think users will behave. This is why A/B tests are so important; they show us what users are actually doing, not what we think they’re doing. But how can you apply this principle to your competitive keyword research? By crowdsourcing your queries.

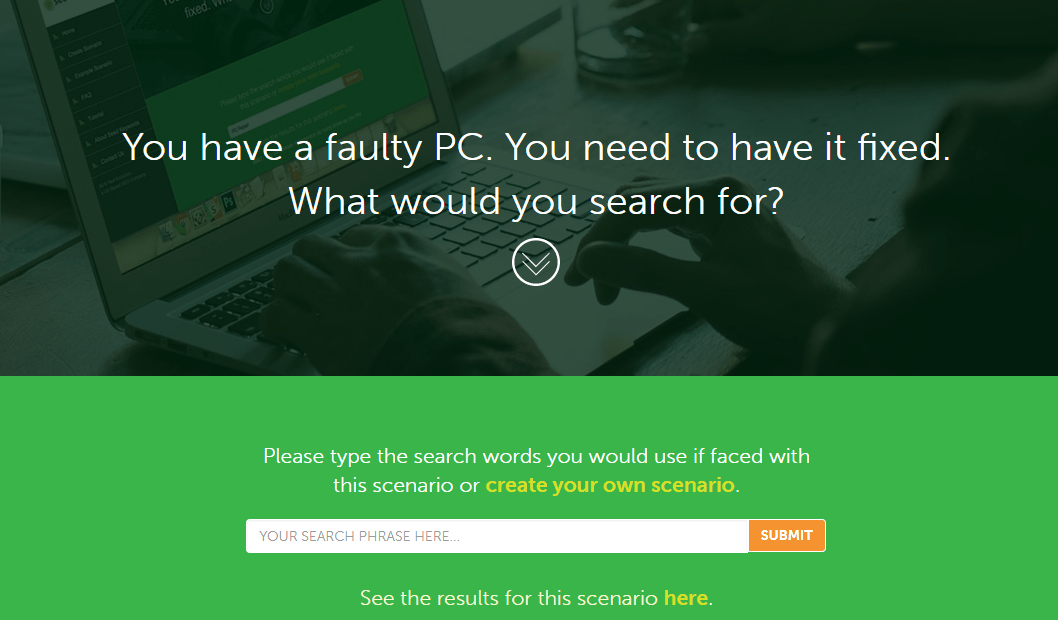

Seed Keywords is a free tool you can use to crowdsource your keyword research. The tool allows you to create custom scenarios by posing hypothetical questions to your friends or coworkers, which can then be used as the basis of actual searches from which we will pull our data.

Here’s an example scenario provided by Seed Keywords:

This is what your friends or coworkers will see when you create your own scenario. In the example above, users are asked what they would search for if they discovered a fault with their computer.

Seed Keywords then allows you to specify which search engine you would like to use in your scenario. By default, the tool offers results for google.co.uk, but since I’m located in the United States, I selected google.com as the search engine I wanted to use, which gave me the following results:

As you can see, some of these results are very broad and predictable, such as “pc repair” and “faulty pc fix.” Others, however, are more specific, and may be more revealing of how users would actually behave in this scenario, such as “hard disk corrupt.” The tool also allows you to download your keyword suggestions as .CSV files for upload to Google Ads and Bing Ads by match type, which is very handy.

Before you get too excited, it’s worth remembering that although this tool allows you to see what people actually search for within the parameters of your scenario, this information may not be truly representative of an actual audience segment; unless you ask hundreds of people to complete your custom scenario, you won’t be working with a statistically significant data set. This doesn’t mean the tool – or the data it gives you – is of no use, it’s just something to consider if you’re seeking representative data.

As its name suggests, Seed Keywords is designed to help you find – you guessed it – seed keywords, or keywords that help you identify potential keyword niches as well as competing advertisers or sites as a starting point for further research. That doesn’t mean you can’t use Seed Keywords as the basis of competitive keyword research – it all depends on how you structure your custom scenario.

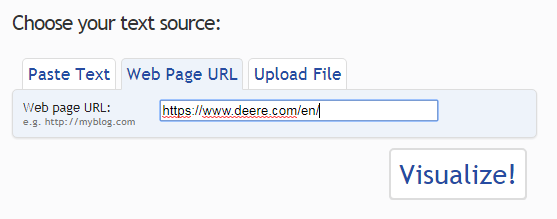

8. Tag Clouds

Ever seen those word clouds that show you the most commonly used words on a page or site? Although this technique is usually reserved for creating inexpensive infographics or visual assets, they can also be used to find keywords on your competitors’ pages.

There are plenty of tools that you can use to create word or tag clouds. For example, let’s say you run an SEO blog and want to find out which keywords your major competitors are using. You can use a software program such as Tag Crowd to see which words are used most frequently on a specific site.

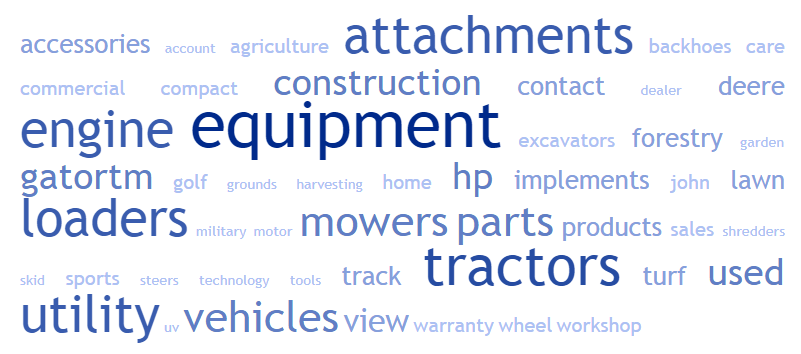

In the example below, I used Tag Crowd to see which are the most commonly used words on the official John Deere website by entering the URL into the appropriate field.

Based on our criteria, Tag Cloud presents us with a visualization of the most common words on John Deere’s website. As you can see, the keywords “attachments”, “equipment”, and “tractors” all feature prominently on John Deere’s site, but there are other frequently used keywords that could serve as the basis for new ad group ideas, such as “engine”, “loaders”, “utility”, and “mowers parts.”

This technique is also very effective for content marketers seeking to identify new topic areas that your competitors are targeting, and can be used in concert with functionality offered by tools such as BuzzSumo in our examples above.

Seek and ye shall find [competitor keywords]

These are just a few of our favorite tools and tactics for discovering the keywords our competitors are targeting and ranking for. Whatever tool you choose to use for keyword research, don’t forget about your competitors; they might be doing something you can learn from!

One final note: bidding on competitor keywords is highly effective but can get expensive. If you’re in need of some lower-cost alternatives, we’ve got you covered! Here are three ways to target your competitors on Google without Search and three more ways to target your competitors on using paid social.

![The 22 Best Keyword Research Tools for Every Need [Free & Paid!]](https://www.wordstream.com/wp-content/uploads/2013/09/keyword-research-tools-feature.png)