Summer’s officially over. In the northeast, the leaves are changing colors, the nights are brisk, and the scent of pumpkin spice is in the air. While it may be tempting to relax in your Uggs and enjoy the fall, there’s no rest for PPC advertisers—just as back to school season is ending, the holiday shopping season has already begun!

We’ve partnered with Google to examine what retailers should expect this coming holiday season based on historical search traffic. As advertisers plan for a busy holiday season, we’ll highlight search trends in the United States, Canada, United Kingdom, and Australia for 12 major retail industries, including:

- Apparel

- Computers

- Electronics

- Food & Groceries

- Hobbies & Leisure

- Home & Garden

- Home Appliances

- Furniture

- Jewelry

- Sports & Fitness Apparel

- Toys & Games

- All retail

When does holiday shopping begin in my industry?

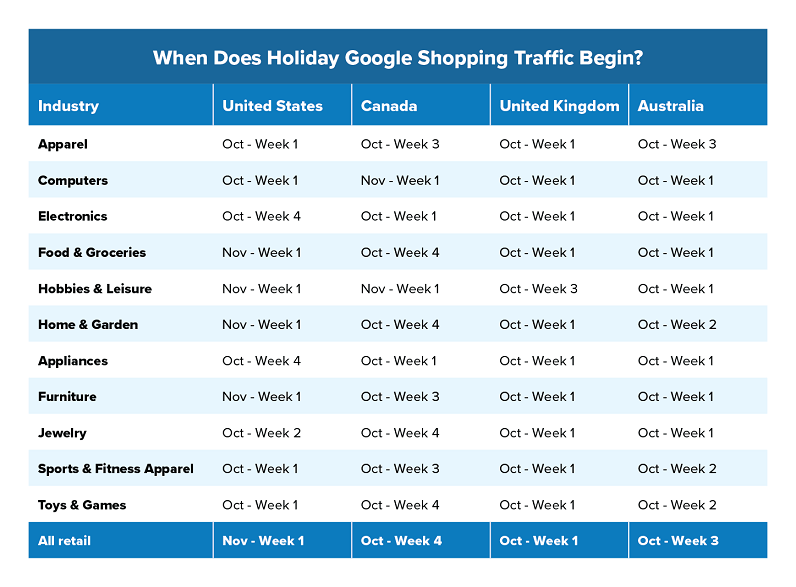

It’ll surprise some to hear how early people begin their holiday shopping! It’s true—the holiday shopping season starts well before Black Friday. Here’s when advertisers can expect to see their campaigns pick up at least 10%:

Many retailers will notice the holiday traffic as early as the first week of October! Particularly in the UK, holiday shopping begins earlier than most would expect. In North America, some industries have more time to prepare for the Holiday rush—shopping for Home & Garden, Appliances, and Furniture don’t pick up until late October and early November. But by the first week of November, just about every retailer should notice significant lift in their campaigns!

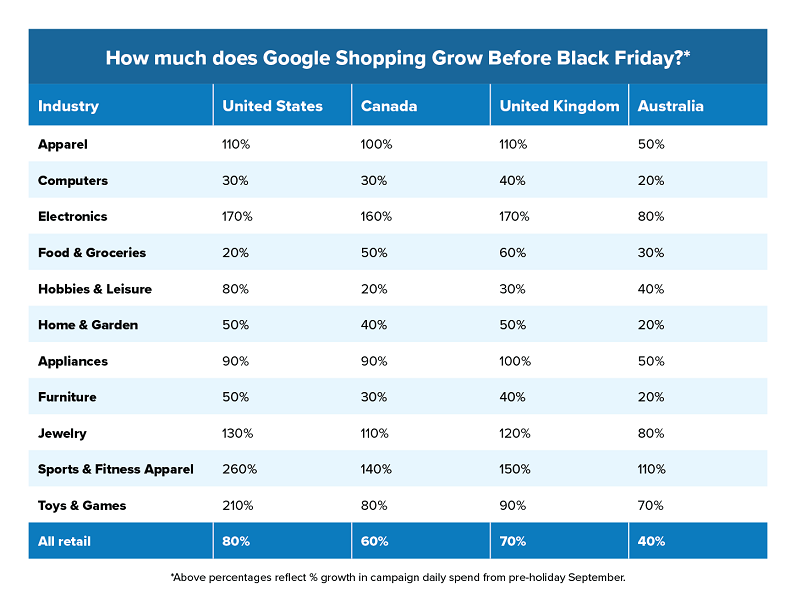

How will my industry’s Google Shopping campaigns grow before Black Friday?

Sooner or later, all retailers will see holiday shoppers flocking to the SERP for their products. While Black Friday and Cyber Monday are the biggest shopping days, many will see traffic pickup well before the big event.

In the US, retailers see an 80% increase in their search traffic throughout November! Some industries, such as Sports & Fitness, Toys, Electronics, and Apparel all more than double their pre-holiday reach before Black Friday. Some industries and markets grow more than others, but all retailers can expect at least a 20% lift prior to the Holidays.

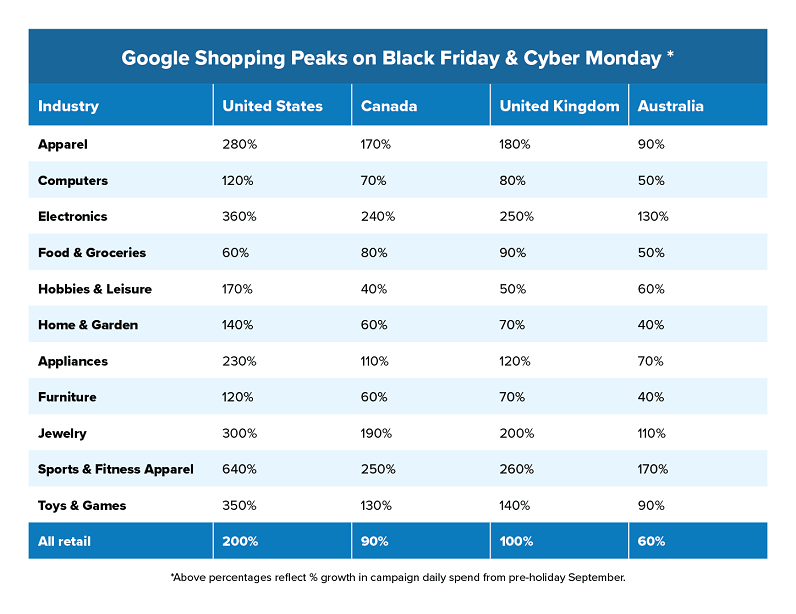

How big are Black Friday & Cyber Monday on Google Shopping?

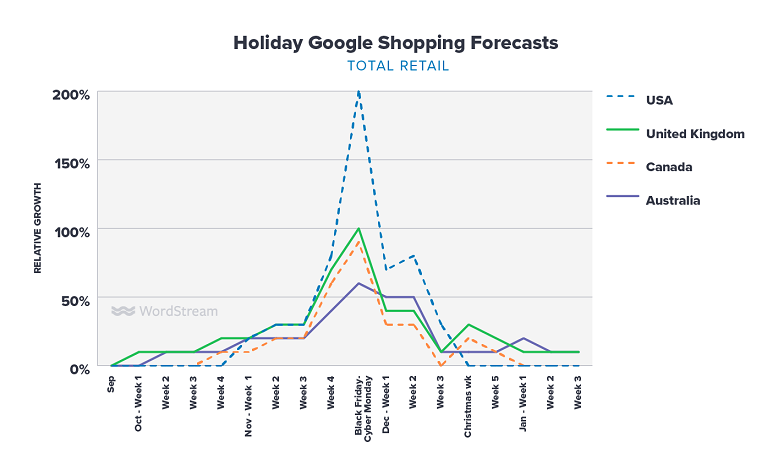

Of course, Black Friday and Cyber Monday are the two largest days for online retailers and trends in Google Ads reflect that. Advertisers can expect to see their campaigns reach over 6x their usual daily traffic on these days.

In the US, retailers can expect 3x their usual daily traffic, spend, and sales on Black Friday and Cyber Monday as the holiday season reaches its peak. Big ticket items—Jewelry, Appliance, Electronics, and Computers—are iconic grabs for the holidays, and retailers in these industries can expect even more searchers than usual on these big days.

Even outside of the United States, Black Friday and Cyber Monday are growing in popularity and international retailers should still expect significant extra opportunity to reach shoppers on Google search these days, oftentimes 2x their normal reach.

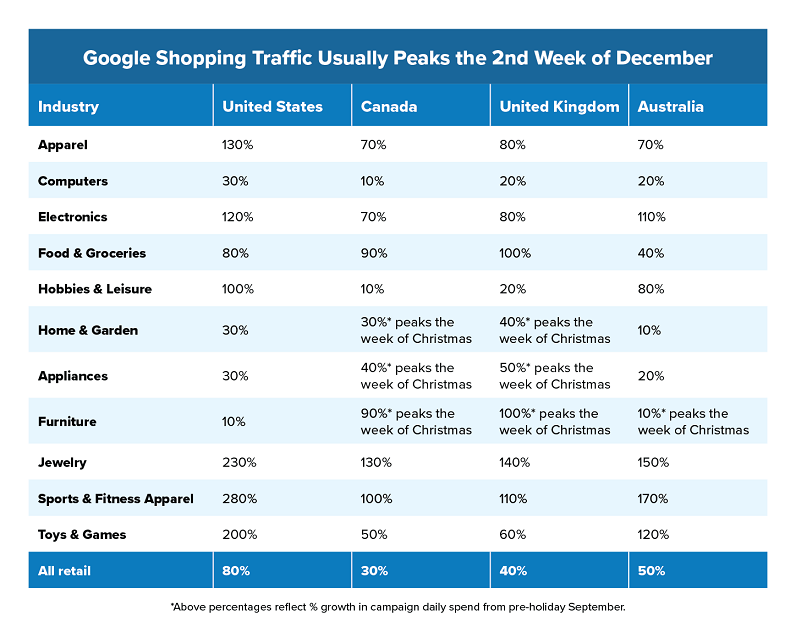

What can I expect from Google Shopping in December?

Although Black Friday and Cyber Monday are the biggest shopping days of the holiday season, shopping traffic continues to grow from November into December. Generally, online holiday shopping traffic on Google peaks during the second week of December, but some regional exceptions offer traffic even later.

On average, Google Shopping traffic is equally high as the pre-Black Friday surge. However, certain industries peak after Cyber Monday. For instance, Food & Grocery shopping is at the highest of the year during the second week of December. Other industries—Appliances, Home & Garden, and Furniture—begin to slow down in December although they often see a small increase in the week of Christmas, particularly in international markets.

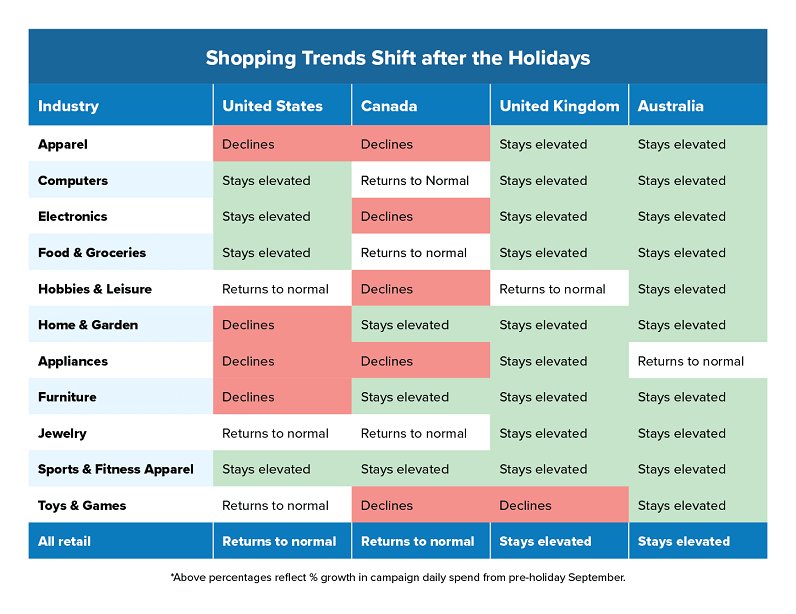

What happens to Google Shopping after the holidays?

Even after every present under the tree is opened and the holidays come to an end, some shoppers continue to flock to Google either to get last minute gifts or to finally splurge on that present for themselves they’ve been eyeing all season long.

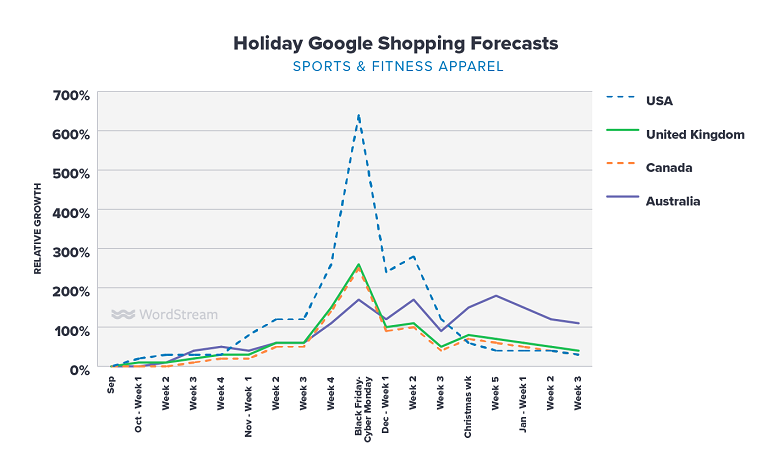

While January is certainly slower than December for ecommerce, many industries still see at least 10% more shopping searches than they would typically see throughout the year. In the US and Canada, many industries enter hibernation for the winter, whereas Australia springs into summer at the same time. Around the globe, though, people leave their holiday parties and Christmas feasts eager to tackle their New Year’s Resolutions. Sports & Fitness Apparel retailers can expect to see at least 40% more Google shoppers than normal after the holidays.

Full Google holiday forecasts by industry

See the full Google holiday forecasts for each industry below in the United States, Canada, United Kingdom, and Australia.

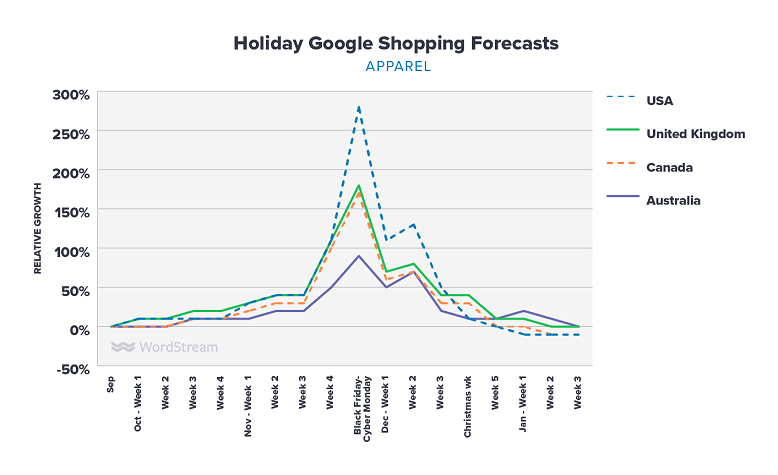

Apparel: Holiday Google Shopping campaigns grow early in October and continue to grow throughout November and mid-December. After the holidays, North America (US and Canada) have slightly lower reach, whereas the UK and Australia enjoy modest post-holiday growth.

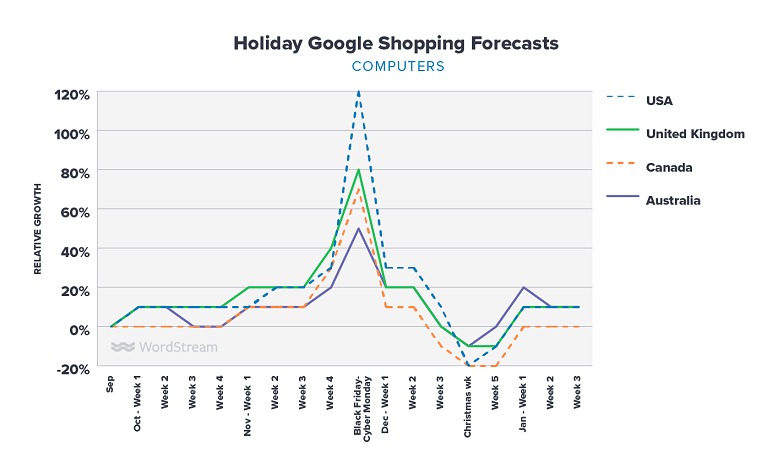

Computers: Holiday Google Shopping campaigns grow modestly early in the season and have a strong spike in the weeks surrounding Black Friday and Cyber Monday. After the second week of December, many computer shopping campaigns have deflated reach.

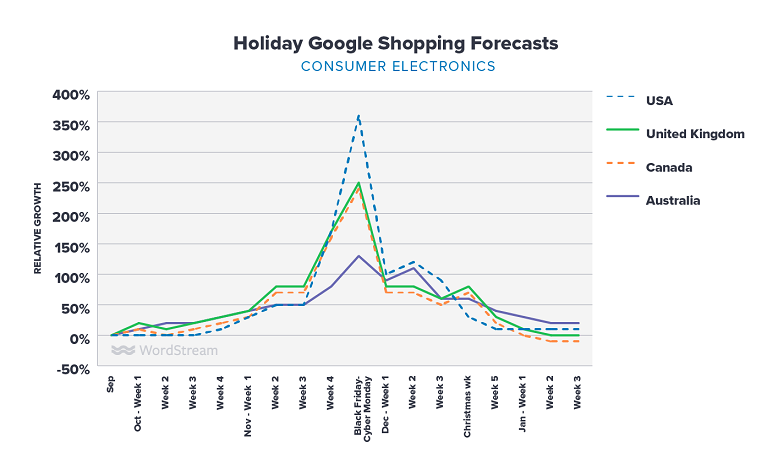

Electronics: Google Shopping campaigns grow evenly until two weeks before Black Friday. The weeks surrounding Black Friday and Cyber Monday are giant spikes. The week of Christmas, these Google shopping campaigns may see a second, smaller spike outside of the US. Expect slightly elevated performance in early January.

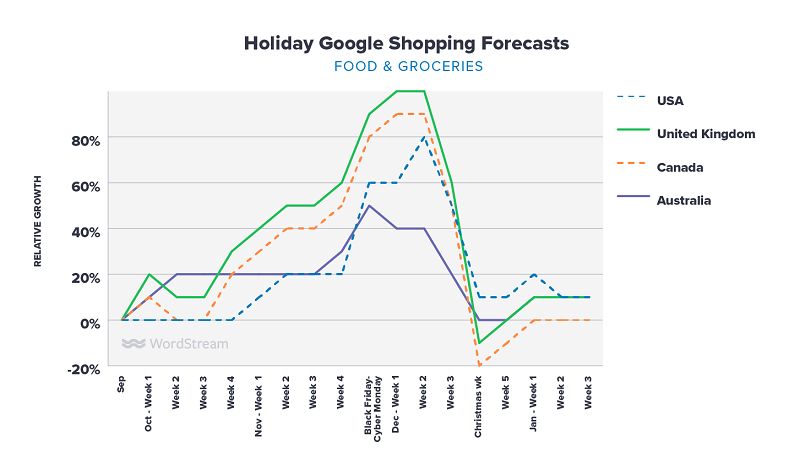

Food & Groceries: Google Shopping campaigns steadily rise throughout the season. While many may notice significant growth around Thanksgiving, campaigns will continue to grow until the week before Christmas and then take a sudden dip.

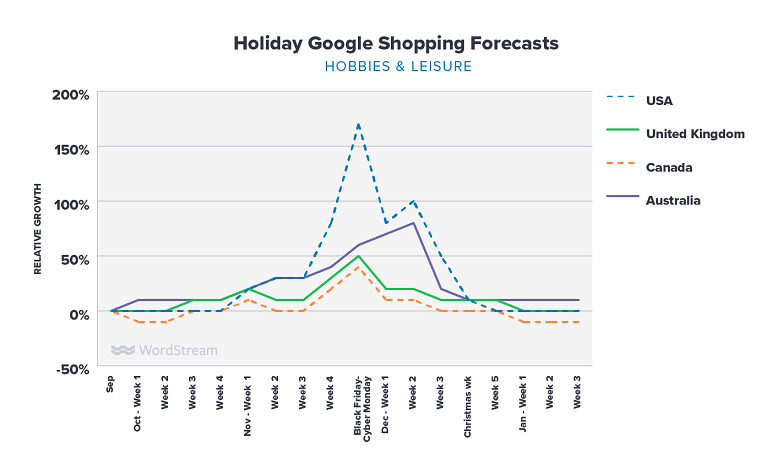

Hobbies & Leisure: Google Shopping campaigns in this industry have limited growth until November. Black Friday, Cyber Monday, and the second week of December are notably strong, but this growth is concentrated to late November and December. By January, these campaigns will continue to perform at pre-Holiday levels.

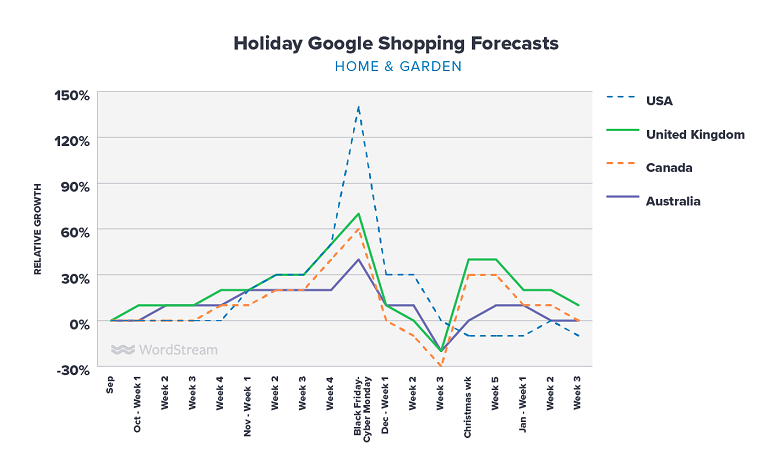

Home & Garden: Google Shopping for Home & Garden often begin later in the season and end sooner, often returning to pre-Holiday levels before Christmas. Outside of the US, there is a second small shopping boom on Google after Christmas.

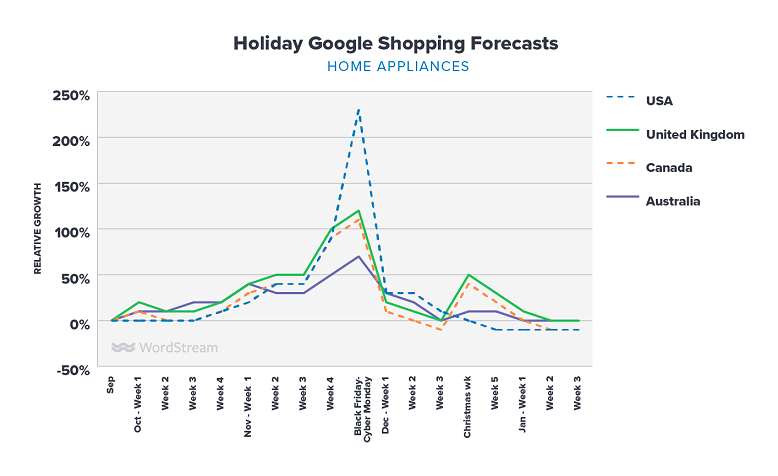

Home Appliances: Big ticket appliances are often planned well in advance of sales and the weeks leading up to Black Friday are the biggest in this industry. Most Holiday Google Shopping is over by the first week of December. The week of the New Year’s may also see a small spike in international markets.

Furniture: November is the biggest month for Furniture on Google Shopping, and December may be the worst. Capitalize early on these sales by setting up these campaigns early and with plentiful budget for a November rush. Outside of the US, prepare for a second significant spike in January, as well.

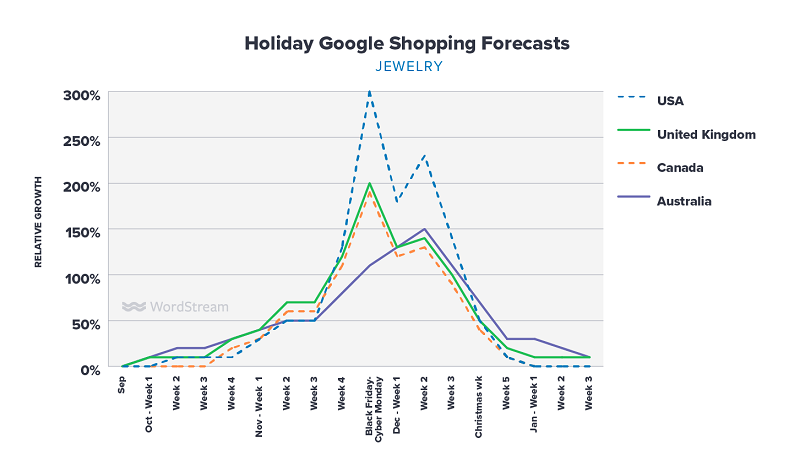

Jewelry: Google Shopping campaigns have steady and expected growth throughout the holiday season with peaks around Black Friday, Cyber Monday, and the second week of December. Even after the holidays, jewelry shoppers continue to flock to Google—at no point should advertisers expect a dip below their pre-Holiday figures.

Sports & Fitness Apparel: Summer bodies are made in winter, but Fitness shopping happens as early as the fall. Throughout the season, these campaigns will have significantly higher reach—peaking at 640% more than their pre-Holiday spend! Even after Christmas, expect these campaigns to spend at least 40% more than they did in September.

Toys & Games: Google Shopping campaigns have modest growth in October and really swell in November and December, through the Holiday season. After Christmas, though, these campaigns generally dip back below their pre-holiday spends for a bit in January.

Total Retail: By the first week of November, all markets should see some double-digit percentage growth in their Google Shopping campaigns. US advertisers should plan for a 200% spike on Black Friday and Cyber Monday and an 80% spike the second week of December. Internationally, advertisers should expect similar trends with about half the magnitude.

Are your Google Shopping campaigns ready for the holidays?

The holiday season is the biggest opportunity for ecommerce advertisers, so it’s vital to make sure your campaigns are prepared to get the most out of the season.

1. Launch your shopping campaigns NOW: If you haven’t started on Google Shopping, it’s not too late! But setting up a feed, organizing your products, and launching your first campaigns can be hard on your own. Start early so that your campaigns can make the most of the season.

2. Prepare your budgets: All search is seasonal, but we see large shifts in demand during the holidays. Depending on your industry, you may need to increase or even double your daily budgets. Over Black Friday and Cyber Monday, some industries should expect to spend over 6x what they would typically prepare for!

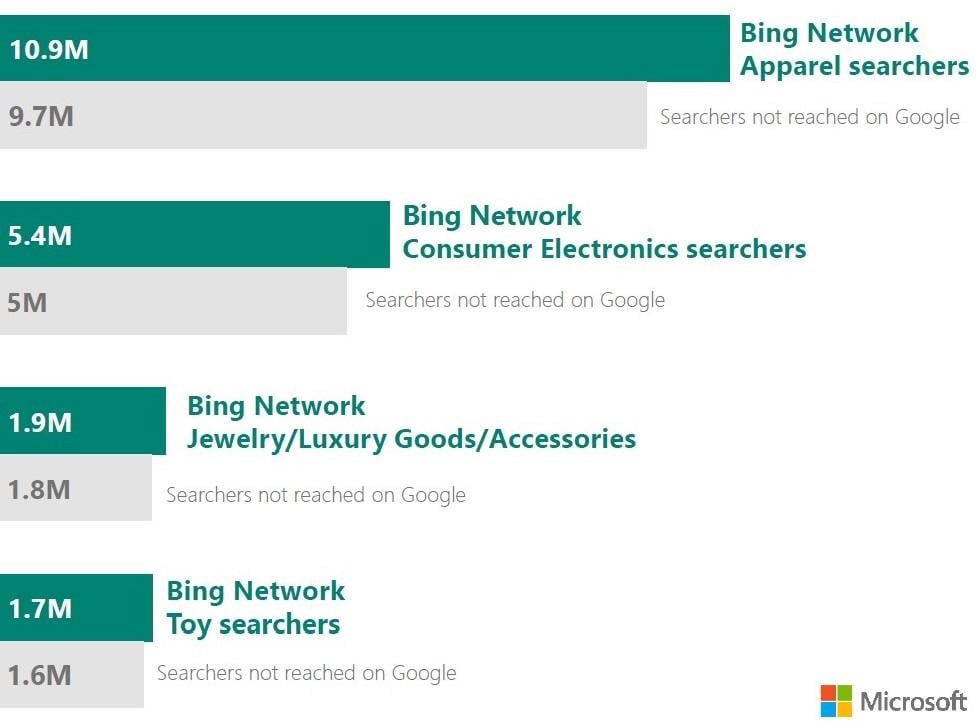

3. Expand to Bing Shopping: These trends aren’t unique to Google—many will be surprised to hear that Bing shopping serves over 744 million retail searches for the holidays. Beyond Bing search, Bing shopping ads reach users on Yahoo, AOL, DuckDuckGo, Amazon, OfferUp, and dozens of other popular publishers. Bing Shopping advertisers also enjoy 30% cheaper clicks than what we see on Google Shopping.

4. Grade your Google Ads Shopping: Whether you’re just starting your first Google Shopping campaign or you’ve been running Shopping ads for years, everyone has room to improve their reach and reduce wasted spend. To see specific opportunities for YOUR Google Shopping campaigns, run our new and improved Google Ads Grader and get a comprehensive review of your shopping campaigns performance, opportunities, and how you stack up against similar advertisers in a matter of minutes!

5. Check performance benchmarks for YOUR industry: In this busy season, it’s hard to know how your campaigns stack up against your competitors. We recently reviewed hundreds of Google and Bing Ads Shopping campaigns in 16 popular industries to create shopping benchmarks their average budgets, click through rate (CTR), cost per click (CPC), conversion rate (CVR), and cost per acquisition (CPA). Review how your shopping campaigns perform against your industry in this post.

And if you’re advertising on search or social, you also may be interested in seeing similar benchmarks for:

- Google Ads Benchmarks for YOUR Industry

- Google Shopping Ad Benchmarks for YOUR industry

- Google Ads Mobile Benchmarks for YOUR Industry

- Bing Ads Benchmarks for YOUR Industry

- Facebook Ad Benchmarks for YOUR Industry

Data Sources:

The data in this post was collected and shared by Google. Historical industry and market performance are used to predict trends in 2019.